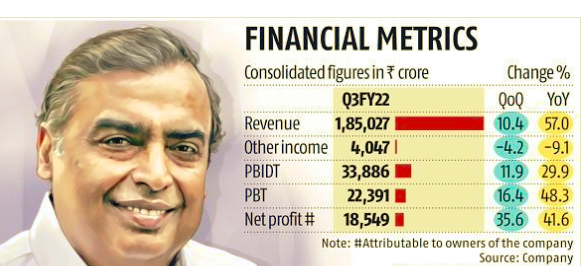

Mukesh Ambani-led Reliance Industries Ltd (RIL) on Friday reported a consolidated net profit of Rs 18,549 crore in the quarter ended December 2021 (Q3)

This makes up 42 per cent over the corresponding period in the previous year on increased revenues and one-time gains due to divesting shale gas assets in North America.

At the reported level, India’s most valuable company’s net profit in the period under review was at a quarterly record high of Rs 20,539 crore, up 37.9 per cent year-on-year.

The company’s consolidated revenues (net of taxes) in Q3 of 2021-22 stood at Rs 1,85,027 crore, up 57 per cent from the same period last year, with the highest contribution from the oil-to-chemicals business, followed by the retail segment.

The reported top line of Rs 2,09,832 crore was the company’s highest ever quarterly revenue, said the management.

The performance was better that the street expectations on all key parameters.

During the quarter, Reliance Eagleford Upstream Holding, a wholly owned step-down subsidiary of RIL, signed agreements with Ensign Operating Ill, LLC, a Delaware-based limited liability company, to divest its interest in certain upstream assets in the Eagleford shale play of Texas, US, said the company.

With this transaction, RIL has divested all its shale gas assets and exited from the business in North America.

This transaction resulted in an exceptional gain on sales of assets amounting to Rs 2,872 crore (part of the oil and gas segment).

The company’s finance cost declined 11.9 per cent on a year-on-year (y-o-y) basis, further strengthening the net profit in the December quarter.

Within the business segments, oil-to-chemicals (O2C) revenues jumped 57 per cent to Rs 1,31,427 crore, followed by retail revenues at Rs 50,654 crore, up 53 per cent.

Exports (including deemed exports) from RIL’s India operations increased 105.3 per cent to Rs 64,781 crore ($8.7 billion) against Rs 31,559 crore a year ago mainly due to both higher price realisations and higher volumes, said the company.

“I am happy to announce that Reliance has posted best-ever quarterly performance in 3Q FY22 with strong contribution from all our businesses. Both our consumer businesses, retail and digital services have recorded highest ever revenues and EBITDA. During this quarter, we continued to focus on strategic investments and partnerships across our businesses to drive future growth,” Mukesh Ambani, chairman and managing director at Reliance Industries, said in a statement.

The company’s consolidated Ebitda was at a record quarterly high of Rs 33,886 crore in Q3, up 30 per cent y-o-y, driven by robust operating performance across businesses.

RIL’s outstanding debt as on December 31, 2021, was Rs 2,44,708 crore ($32.9 billion) with cash and cash equivalents as on December 31, 2021 at Rs 2,41,846 crore ($32.5 billion), said the company.

Capital expenditure (including exchange rate difference) for Q3 was Rs 27,582 crore ($3.7 billion) and for nine months ended December 31, 2021, was Rs 69,303 crore ($9.3 billion).

Additionally, Rs 43,589 crore ($5.9 billion) were incurred towards acquiring spectrum by Reliance Jio, it said.

“We are making steady progress towards achieving our vision of Net Carbon Zero by 2035. Our recent partnerships and investments in technology leaders in the solar and green energy space is illustrative of our commitment to partner India and the World in the transition to clean and green energy,” said Ambani.