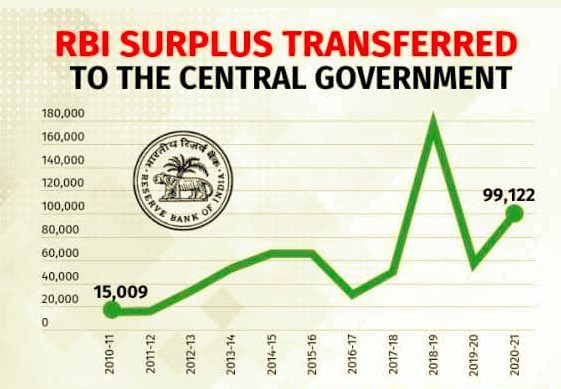

The Reserve Bank of India (RBI) will transfer Rs 99,122 crore to the Union government for the nine-month accounting period ended March 31, the central bank has said.

The bank also decided to maintain the contingency risk buffer at 5.5 percent. The decisions were taken at the 589th meeting of the Central Board of Directors of RBI held under the chairmanship of Governor Shaktikanta Das on May 21.

The RBI is required to maintain a contingency risk buffer of 5.5-6.5 percent of its balance sheet.

This is much higher than what most had estimated and what the government itself had budgeted for. Finance Minister Nirmala Sitharaman had earmarked a transfer of Rs 53,511 crore.

The transfer was approved on Friday, in the meeting of the regulator’s central board, during which the RBI’s annual report was also approved.

[splco_Shortcodesspacer]

[splco_Shortcodesspacer]

The central bank has changed its accounting period, aligning it with the fiscal calendar (April-March) from this year, instead of the earlier July-June calendar.

Therefore, the transfer of nearly a trillion rupees for just nine months of operation is surprising, though it will come as a huge respite to the government.

“The surplus to be transferred by the RBI to the Government of India is considerably higher than the budgeted level.

This will offer a buffer to absorb the anticipated losses in indirect tax revenues during May-June, owing to the impact of state lockdowns on consumption on discretionary items and contact-intensive services,” said Aditi Nayar, chief economist of ICRA.

Direct tax collections are also expected to be soft, given the compression in demand.

How the RBI could transfer such a huge amount will be explained only after release of its annual report, but it was done keeping the rules of the Jalan Committee on the RBI’s economic capital intact.

The committee had recommended that the RBI maintain, at all times, a minimum contingency risk buffer of 5.5 per cent of its balance sheet, which the central bank did.

From FY2018-19, after the Jalan committee’s recommendation, the RBI changed its valuation policy to recognise gains from the sale of foreign currency against the historical weighted-average holding cost.

However, purchase of foreign currencies is treated separately, and any fresh purchase contributes to the weighted-average cost.

If one assumes all the RBI’s foreign currency reserves are in dollars, the weighted-average holding cost for the dollar would be around Rs 55.70, going by last year’s annual report.

The high transfer also takes into account the record open market operations (OMO) conducted by the RBI in the last fiscal year.

It had bought bonds worth Rs 3 trillion during the fiscal, on which it must have earned a healthy interest income from the government. This amount could have been repatriated back to the government.

The RBI had transferred Rs 57,128 crore to the government for the accounting year 2019-20.

The year before, the RBI had, based on the Jalan Committee formula, transferred a record Rs 1.76 trillion, which included Rs 1.23 trillion as dividend and Rs 52,637 crore of excess provisions.

What this literally means the interest income RBI gains from the government bonds has been repaid to the government itself as advance as excess provision and this accounts Rs 52,637 crore.