Global stocks fell drastically on Tuesday, a day after US crude oil prices turned negative for the first time in the History of Oil trade , as dismal company earnings reports underlined worries about economic damage from the coronavirus pandemic.

MSCI’s All Country World Index, which tracks stocks across 49 countries, was down 0.8 per cent.

European stock markets followed their Asian counterparts lower, with the pan European STOXX 600 index down nearly 2 per cent in early deals.

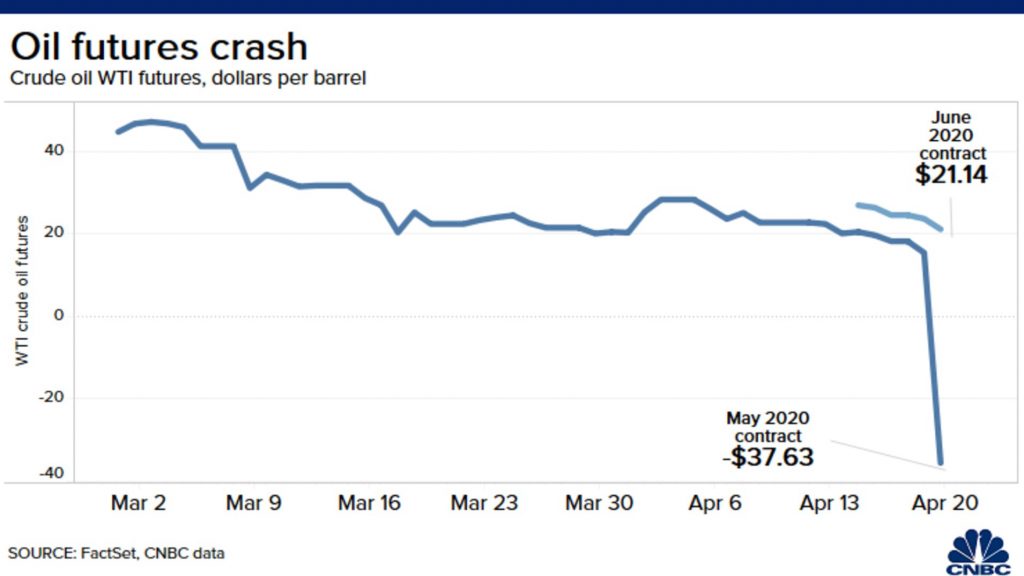

In commodity market, Brent Crude futures slipped below $20 a barrel, a day after WTI Crude futures slipped into the negative zone amid fears that the sector will run out of storage for a glut caused by the coronavirus lockdown.

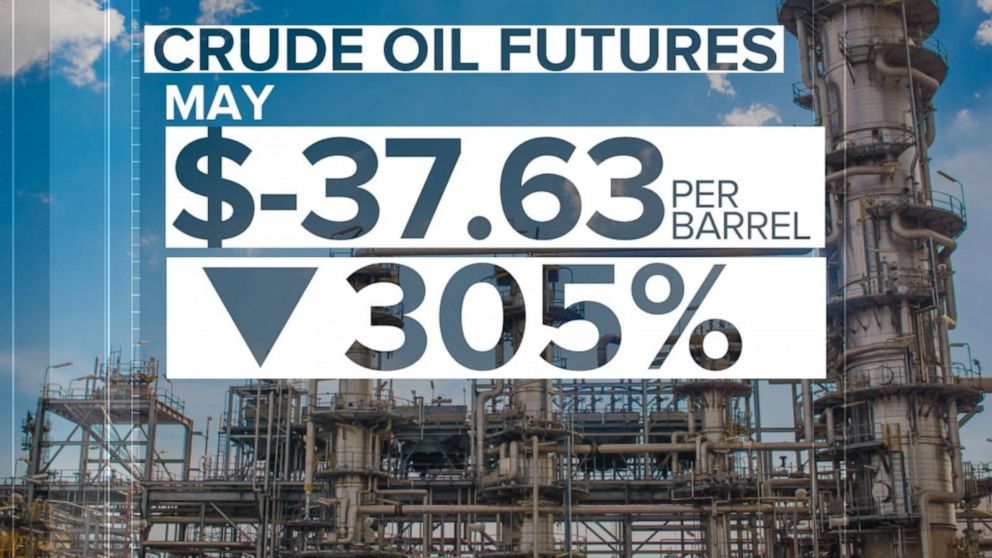

US West Texas Intermediate (WTI) crude for May delivery traded at minus $2.58 a barrel, up $35.05 from Monday’s close when the contract settled at a discount of $37.63 a barrel.

[splco_spacer]

[splco_spacer]

In reaction to this Indian benchmark Sensex indices ended over 3 per cent lower on Tuesday amid collapse in crude oil prices and weak global markets. The session witnessed heavy selling in financial, metal, energy, and auto stocks.

The S&P BSE Sensex tanked 1,011 points or 3.2 per cent to settle at 30,637 while NSE’s Nifty slipped 280 points or 3 per cent to 8,981 levels. Volatility index, India VIX, jumped over 4 per cent to 45.34 levels.

Shares of oil and gas companies slipped on Tuesday, a day after the US crude oil futures collapsed below $0 on Monday for the first time in history, amid a coronavirus-induced supply glut, ending the day at a stunning minus $37.63 a barrel as desperate traders paid to get rid of oil.

In the Sensex pack, 27 out of 30 stocks ended in the red. IndusInd Bank (down 12 per cent) emerged as the biggest loser on the index, followed by Bajaj Finance (down 9 per cent), ICICI Bank (down over 8 per cent), and Axis Bank (down 7.6 per cent).

Among individual stocks, Oil and Natural Gas Corporation (ONGC) was trading over 6 per cent lower at Rs 69.45 apiece and was the biggest loser on the Oil & Gas index.

Next on the list were GAIL (down around 5 per cent), Reliance Industries (down nearly 4 per cent), and Petronet LNG (down 3 per cent). Among oil marketing companies, Indian Oil Corporation (IOC) was down over 3 per cent at Rs 84.85 while BPCL was down over 1 per cent at Rs 363.40. HPCL was down 1.6 per cent at Rs 223.70.

[splco_spacer]

[splco_spacer]

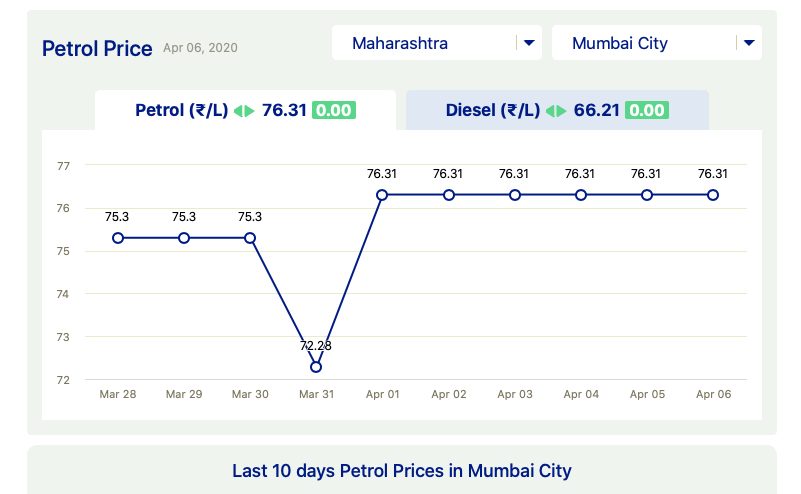

The Crude oil price changes does not have any impact on Indain market due to 300% + tax charges collection by both Centre BJP govt led by Modi and local state governments