Credit crunch among both banking and non-bank financial institutions (NBFIs), major providers of retail loans in recent years, has compounded the problem.

Moody’s pointed that the prospects for fiscal consolidation look limited but rapid deterioration is also unlikely.

“With the recently announced corporate tax cuts and lower nominal GDP growth, we now expect a central government deficit of 3.7 per cent of GDP in fiscal 2019, marking a 0.4 percentage point slippage from its target,” it said.

“A prolonged period of slower nominal GDP growth not only constrains scope for fiscal consolidation, but also keeps the government debt burden higher for longer compared with our previous expectations.

Based on our debt sensitivity analysis, under nominal growth of around 11 per cent, close to our baseline assumption, the debt burden will remain broadly stable at around 68 per cent of GDP, and decline slightly toward 66 per cent by 2023.

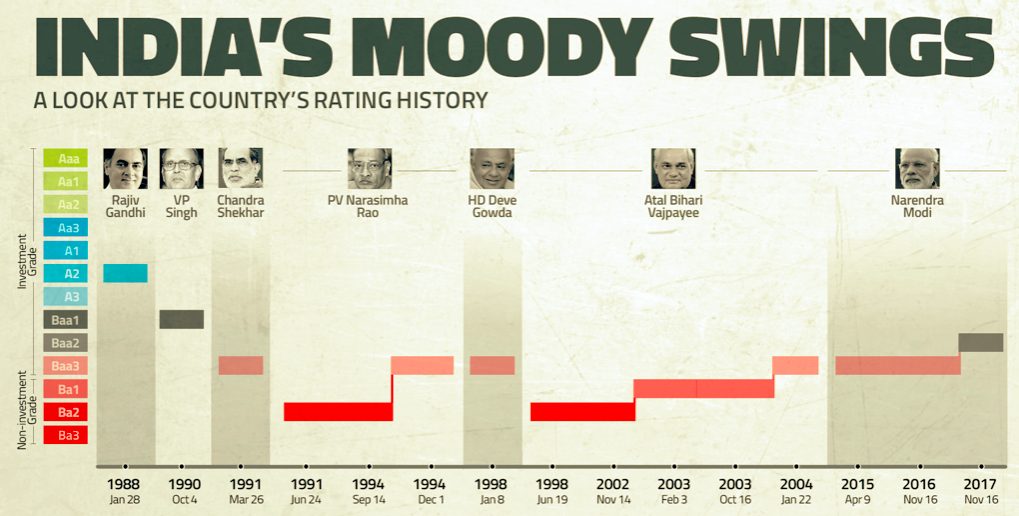

Moody New York-based global credit rating agency, upgraded its rating on India’s sovereign bonds for the first time in nearly 14 years during 2017 The agency said it was lifting India’s rating to Baa2 from Baa3 and changing its rating outlook to “stable” from “positive” at that time

It should be noted during 2017 Moody’s expressed its belief that continued progress on economic and institutional reforms would enhance the India high growth potential.

It also expressed faith in the pace of changes, including the introduction of the GST, demonetisation, measures to tackle bad loans and the attempt to push the envelope on Aadhaar – all of which have drawn fire from opponents of the government.

During the rating change is the first ratings upgrade for India by Moody’s since January 2004. India been made on a par with Italy and Philippines and a notch above Indonesia.

During 2017 Moody’s forecast real GDP growth this year at 6.7 per cent – broadly in line with the projections made by the IMF and the RBI – and expected it to rise to 7.5 per cent next year. “India’s growth potential is significantly higher than most Baa-rated sovereigns,” it added.

But now the forescast growth rate has been bought down to 5.8% from projected 6.7 % means 16% drop on cards .