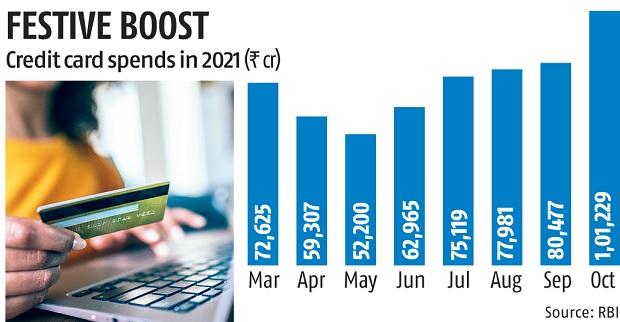

In India during Diwali estival season credit card spends for the first time crossed Rs 1 trillion in a month in October, revealed the latest figures released by the Reserve Bank of India (RBI) on Thursday.

Spends in October registered a growth of over 25 per cent month-on-month, despite a high base of last month.

On a year–on–year basis, credit card spends jumped 56 per cent. In the corresponding period last year, credit card spends were to the tune of Rs 64,891.96 crore.

The earlier highest one-month spend came in September this year at Rs 80,477.18 crore.

The month before, spends were nearly Rs 77,981 crore.

Spends recorded in the past few months have been much higher than that of pre-pandemic levels. In January and February of 2020, credit card spends were Rs 67,402.25 crore and Rs 62,902.93 crore, respectively.

“Credit card spends have been quite robust in the past few months owing to strong economic rebound. Also, October was a festival month. That could have led to higher growth in credit card spends,” said Suresh Ganapathy, associate director, Macquarie Capital.

Nitin Aggarwal, vice-president, research-banking sector, institutional equities, Motilal Oswal Financial Services, said, “Growth in credit card spends in the past few months signals economic revival.

Card acquisition rates have picked up, bolstering spending power.”

Apart from online spends, physical spending, too, returned this festival season.

This trend may persist, given an under-penetrated credit card market and digital spending seeing growth spurt.

Card acquisition should also see double-digit growth, with HDFC Bank back in the market, ICICI Bank and SBI Cards maintaining healthy growth,” added Aggarwal.

Shyam Srinivasan, managing director and chief executive officer, Federal Bank, said,

“Retail loans are growing and so are credit card spends. It is a steady rise, not a wild pattern. The bank will grow the credit card portfolio in a calibrated manner.”

Furthermore, for the second consecutive month, the banking system reported more than 1 million new credit card additions, taking the number of outstanding cards in the system to 66.3 million.

In October, 1.33 million new credit cards were added; in September, 1.09 million new cards were added. In August, 520,000 cards were added to the system, and among major credit card players, ICICI Bank has been the most aggressive.

ICICI Bank added 278,189 cards; Axis Bank 219,533 cards, and SBI Cards 183,960 cards.For ICICI Bank, its tie-up with e-commerce giant Amazon has worked really well since their co-branded credit card has been a huge success in the market.

The spike in credit card additions in the past two months can be partially attributed to the re-entry of HDFC Bank in the credit card market. In mid-August, the RBI lifted the embargo on HDFC Bank with regard to the issuance of new cards. Since then, the bank has expressed its intention to come back with a bang and regain market share it lost during its eight-month ban.

Axis Bank added 630,022 cards during the same period. Its co-branded credit card with Walmart backed e-commerce major Flipkart has also performed very well.