The new board of IL&FS headed by non-executive chairman Uday Kotak has revealed that the infrastructure financier has a maze of 348 entities.

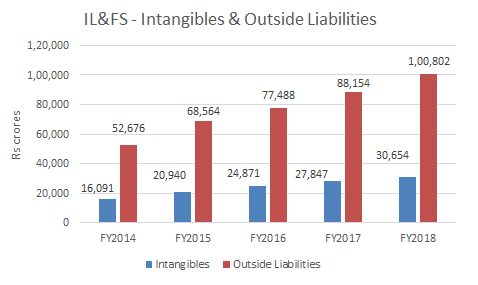

This means that the debt could far exceed the Rs 91,000 crore liabilities that was earlier estimated. Initial assessment had revealed that the financier has 169 subsidiaries.

Uday Kotak, the non executive chairman of the board, said at a press conference that “it is a complex structure with a number of subsidiaries. We need to assess the exact extend of liabilities.

There are bank loans, NCDs, preference capital and there is off balance sheet exposure and contingent liabilities. So in that sense it is far more complex than the Satyam case.

The debt of Rs 91,000 crore was as of March 31, 2018. So that figure is a moving one.”

Calling the scale of the crisis in IL&FS much bigger than Satyam, Kotak said, “There are three to four options before the newly constituted Board and the Board will take steps to preserve the value. Unlike the Satyam case they have not found any evidence of felony so far.”

“We are a legally constituted body unlike a shareholder led board. The board will meet frequently to prepare the road map” added Kotak.

The Board will ensure that an enabling environment is created so that the institution can carry on its work, said Vineet Nayyar, vice-chairman and MD of IL&FS.

The committee in the meantime has formed four committees the audit committee headed by board member Nand Kishore, nomination and a remuneration committee headed by Uday Kotak, a stakeholders’ committee headed by former Sebi chairman GN Bajpai, and a corporate social responsibility committee headed by ex-bureaucrat Malini Shankar.

“We have four different options before us so that we protect the intrinsic value of the institution. We will study those in detail and decide the best way forward,” said Kotak.

The Board is expected to meet frequently to work out a resolution plan that may involve sale of its non-core assets, a rights issue among others.

.

IL&FS was formed in 1987 as an “RBI registered Core Investment Company” by three financial institutions owned by the government of India, namely the Central Bank of India, Housing Development Finance Corporation (HDFC) and Unit Trust of India (UTI), to provide finance and loans for major infrastructure projects

It additionally added two large international players, namely Mitsubishi (through Orix corporation Japan) and the Abu Dhabi Investment authority.

Subsequently, Life Insurance Corporation India, Orix and ADIA became its largest shareholders, a pattern that continues to this day.

As of March 2018, the largest shareholders of IL & FS Investment services were as follows :

- LIC : 25%

- ORIX Corporation, Japan (a part of Mitsubishi Keiritsu): 23%

- IL & FS Employees welfare trust : 12%

- Abu Dhabi investment authority : 12%

- HDFC Ltd : 9Central bank of India : 7%

- State Bank of India : 6%