The Reserve Bank of India’s (RBI’s) foreign exchange reserves declined by $1.1 billion ( Equivalent to India rupees 9000 crores ) to $529.99 billion in the week ended November 4, according to the latest data released by the Reserve bank of India .

The latest decline in the reserves was primarily on account of a fall in the RBI’s gold reserves, which fell by $705 million to 37.06 billion, the data showed.

The RBI’s foreign currency assets registered only a marginal fall of $120 million to $470.73 billion in the week ended November 4.

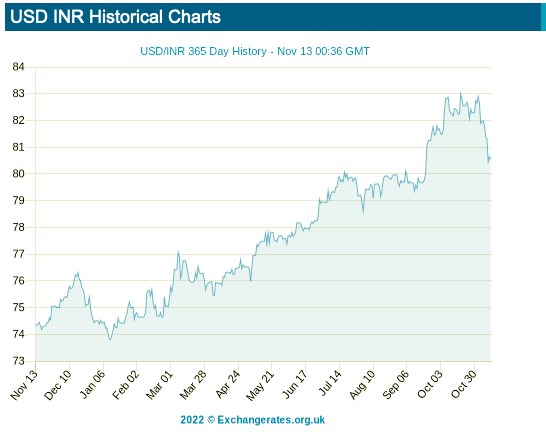

In the previous week, the rupee was largely steady against the US dollar, with the local currency appreciating 0.04 per cent.

What is worrisome factor is RBI’s foreign exchange reserves have decreased sharply partially due to the central bank’s efforts to smoothen out volatility in the exchange rate due to import export trade deficit .

RBI sources indicate in the past 10 months a whopping of 20% drop in foreign exchange reserves that is almost equal to 830000 Crores Indian rupees

The reserves were at $631.53 billion as on February 25.

RBI Governor Shaktikanta Das had said in September that 67 per cent of the decline in reserves in the current financial year were due to revaluation in the face of a strengthening dollar.

The level of reserves in September 2021 were equivalent to almost 15 months of imports.

However, with the dollar index having weakened sharply over the past few days, currency experts see a favourable impact on the RBI’s reserves going ahead.

The US dollar index has weakened more than 5 per cent since November 3, driven to a great extent by a lower-than-expected US inflation print. US bond yields have declined sharply too.

“The reserves, which had gone down because of dollar strength, will also be recovered to a reasonable extent,” Nitin Agarwal, head of trading at ANZ Bank said.