India has an estimated 985 million cards, which are used for about 15 million daily transactions worth Rs 4,000 crore, CII said.

Credit card buys seen 8% lower in Apr-June quarter, say analysts

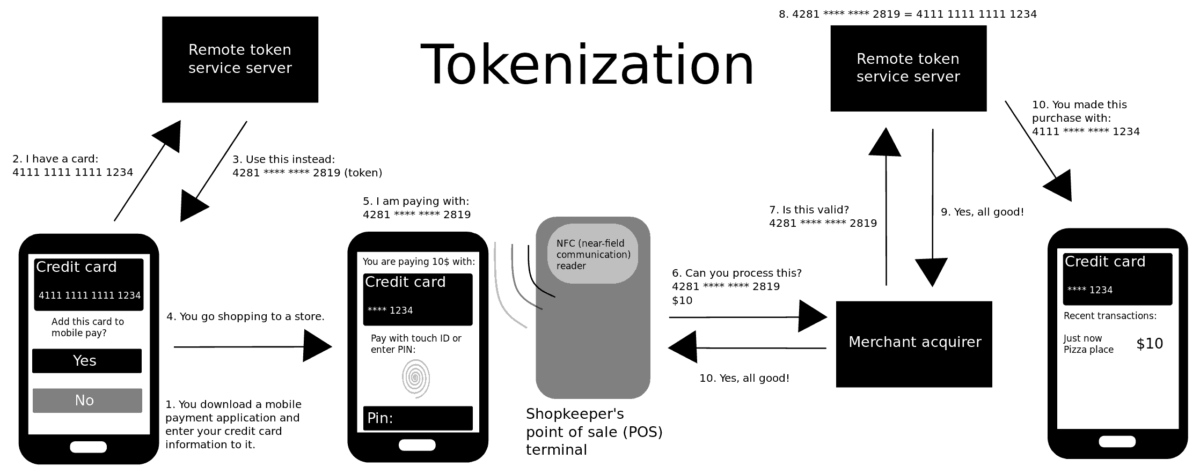

Amid requests from industry stakeholders, Reserve Bank of India on Thurday extended card tokenisation deadline by six months to June 30, 2022.

The value of the Indian digital payments industry in 2020-21, as per the RBI’s annual report, was Rs 14,14,85,173 crore, it said adding that digital payments have triggered and sustained economic growth, especially through the trying times of the pandemic.

Online merchants can lose up to 20-40 per cent of their revenues after December 31, industry body CII said.

“Online merchants can lose up to 20-40 per cent of their revenues post 31 December, and for many of them, especially smaller ones, this would sound the death knell, causing them to shut shop,” CII had said.

Above observations been made in reaction to the card data storage norms deadline on December 31, 2021.

Merchants had lately sought at least six more months to implement new card data storage norms saying as any haste in enforcement may cause major disruptions, erode trust in digital payments and loss of revenue.

The system, including banking entities is still not fully ready to comply with Reserve Bank of India’s for card-on-file tokenisation deadline of December 31, 2021, they said.

Seeking phase implementation of new norms, Merchant Payments Alliance of India (MPAI) and the Alliance of Digital India Foundation (ADIF) said merchants should get a minimum six months to comply with post readiness of banks, card networks, and payment aggregators/ payment gateways.

There was also a need to create consumer awareness about the impact of the policy change, industry lobby groups had said in a joint letter to RBI.

Hence online merchants pleas RBI on Thursday said “The timeline for storing of CoF data is extended by six months, i.e., till June 30, 2022; post this, such data shall be purged,”

Post June 30, 2022, merchants will not be able to store card information of users and will have to replace each card number with a randomised token number.

“In addition to tokenisation, industry stakeholders may devise alternate mechanism(s) to handle any use case (including recurring e-mandates, EMI option, etc.) or posttransaction activity (including chargeback handling, dispute resolution, reward / loyalty programme, etc.) that currently involves / requires storage of CoF data by entities other than card issuers and card networks,” RBI added in a statement.