On June 25, VIL had approached the Department of Telecommunications to seek a one-year moratorium on Rs 8,200-crore spectrum instalment which is due in April 2022. In its letter, the company said it would be unable to pay the spectrum dues because of inadequate cash generation and payment of AGR liabilities.

On July 23, the Supreme Court dismissed the petitions of VIL and Bharti Airtel seeking correction in claimed errors in calculating the AGR.

VIL had calculated its remaining AGR dues at around Rs 21,500 crore after making a payment of Rs 7,800 crore. However, DoT concluded the company’s total AGR liability was around Rs 58,000 crore.

The Aditya Birla Group chairman and promoter of VIL made the suggestion in a letter to Union Cabinet Secretary Rajiv Gauba on June 7.

The VIL debt has more than trebled in the last four years to Rs 1.6 trillion as of end of March 2021, from around Rs 37,000 crore in FY16. This includes deferred spectrum obligations and adjusted gross revenue (AGR) liabilities.

Birla made the suggestion to give up his control of the company more than a month before the Supreme Court dismissed the company’s application for recalculation of the AGR dues, highlighting the need for urgent measures from the government.

“It is with a sense of duty towards 27 crore (270 million) Indians connected by VIL, I am more than willing to hand over my stake in the company to any entity-public sector/government/domestic financial entity or any other that the government may consider worthy of keeping the company as a going concern,” Birla said in his letter.

[splco_Shortcodesspacer]

The VIL board had last September announced a plan to raise Rs 25,000 crore but investors have not been forthcoming in the absence of government support.

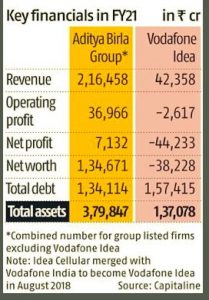

The fundraising is, however, tough given VIL’s negative net worth and consistent losses. The company has cumulatively lost Rs 1.37 trillion in the last five years. As a result, its net worth declined from around Rs 24,000 crore in FY16 to negative Rs 38,000 crore in FY21.

In FY21, the group listed companies (ex-VIL) reported net profit of Rs 7,132 crore against VIL’s net loss of around Rs 44,200 crore. In the last five years, AV Birla group companies cumulatively earned net profits of Rs 37,600 crore–a fraction of VIL’s cumulative loss of Rs 1.37 trillion since FY16.

On the balance sheet side, VIL’s cumulative reserves & surplus of negative Rs 67,000 crore are equivalent to nearly half of the combined net worth of the group’s other listed companies.

Analysts say that VIL losses could potentially swamp the group finances making Birla wary of making additional investments in the company. They say it’s better for the group to cut its losses in VIL and redirect group capital and resources to profitable businesses such as cement, metals, financial services, fashion and retail.

VIL had last raised Rs 25,000 crore worth of equity from its shareholders including promoters through a rights issue in April 2019. The company was left with cash & bank balance of only around Rs 2,200 crore at the end of March this year.

The Birlas own over 27 per cent stake in VIL while Vodafone Plc holds more than 44 per cent in the company. At the time of the merger, the company stock was trading at Rs 34, it closed at Rs 8.25 on the BSE on Monday. The current market capitalisation of VIL is at more than Rs 23,000 crore.