India’s biggest ever auction of telecom spectrum failed to receive the base price set by union government .

Union government earlier set base price for auction price as at 430000 Crores Rupees ..

In the end of 5 days after multiple rounds of auction amongst only 4 parties fetched Rs 1.5 lakh crore of bids, with Mukesh Ambani’s Jio cornering nearly half of all the airwaves sold with an Rs 88,078 crore bid.

India fastest grown Richest Indian Gautam Adani’s group, whose entry in the auction was billed by some as another flash point in the rivalry with Ambani, paid Rs 212 crore for 400 MHz, or less than one per cent of all spectrum sold, in a band that is not used for offering public telephony services.

Telecom tycoon Sunil Bharti Mittal’s Bharti Airtel made a successful bid of Rs 43,084 crore, while Vodafone Idea Ltd bought spectrum for Rs 18,799 crore.

Telecom Minister Ashwini Vaishnaw said of the 72,098 MHz of spectrum offered across 10 bands, 51,236 MHz, or 71 per cent, was sold.

In all, bids worth Rs 1,50,173 crore were received, he said, adding the government will in the first year get Rs 13,365 crore.

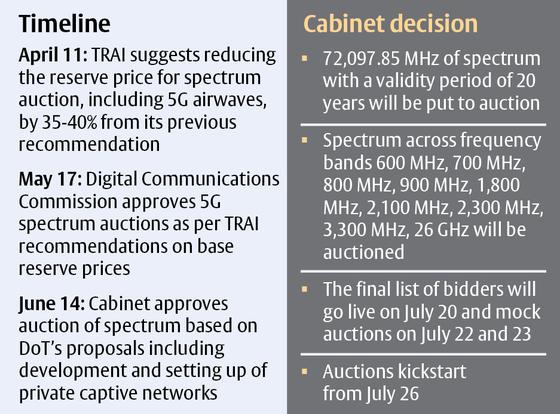

The Cabinet has gone along with the pricing recommendations of the Telecom Regulatory Authority of India (TRAI) which had set a 39 per cent cut in the reserve or floor price for the 5G spectrum sale for mobile services.

Accordingly, the sale value as per the base reserve prices is around ₹4.3-lakh crore. Telcos, on their part, had asked for a 90 per cent cut in the reserve price of airwaves from the 2018 levels.

Barring the 1800 MHz band, for which Jio and Airtel engaged in fierce bidding, spectrum in all bands was sold at reserve (base) price, he noted.

The mop-up from the 5G spectrum, which is almost 10 times faster ultra-high speed mobile internet connectivity, is just double of Rs 77,815 crore worth 4G airwaves sold last year and triple of Rs 50,968.37 crore garnered from a 3G auction in 2010.

Reliance Jio was the top bidder, offering a cumulative bid of Rs 88,078 crore for 24,740 MHz of airwaves across five bands capable of offering speeds about 10 times faster than 4G, lag-free connectivity, and can enable billions of connected devices to share data in real-time.

It acquired the coveted 700 MHz spectrum that can provide 6-10 km of signal range with one tower and forms a good base for offering fifth generation (5G) services, in all 22 circles or zones in the country.

Adani group bought spectrum in the 26 GHz band, which is suitable for setting up a private network for end-to-end communication, in six states — Gujarat, Mumbai, Karnataka, Tamil Nadu, Rajasthan and Andhra Pradesh.

Airtel bought a total of 19,867.8 MHz of spectrum across five bands but none in 700 MHz.

whereas Vodafone Idea acquired 6228 MHz of airwaves.

Vaishnaw said the 600 MHz band, offered for the first time, did not receive any interest.

“Spectrum purchased is good enough to cover all circles in the country. Coming 2-3 years, we will have good 5G coverage,” he noted.

He said the 26 GHz application will be for non-public networks, offering fixed wireless access. “It is a good alternative to fibre for last mile connectivity.”

The Minister said allocation will be made by August 10 and 5G services are expected to be rolled out from October.

“With better availability of the spectrum, call quality is expected to improve,” he said.

The government had put on offer spectrum in 10 bands but received no bids for airwaves in 600 MHz.

About two-thirds of the bids were for the 5G bands (3300Mhz and 26Ghz), while more than a quarter of the demand came in the 700 Mhz band – a band that had gone unsold in the previous two auctions (2016 and 2021). The 1800 MHz band and 900 MHz bands (where Bharti Airtel and Vodafone Idea have footprint) got demand.

Unlike the previous two auctions where no interest was seen in the 700 MHz band, this time there was demand across 22 circles with 40 per cent of the total available spectrum being acquired.

In the auction conducted last year for 4G that had lasted two days – Reliance Jio picked up spectrum worth Rs 57,122.65 crore, Bharti Airtel bid about Rs 18,699 crore, and Vodafone Idea bought spectrum worth Rs 1,993.40 crore.

This year, a total of 72 GHz (gigahertz) of radiowaves worth at least Rs 4.3 lakh crore was put on the block.

The auction was held for spectrum in various low (600 MHz, 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz), mid (3300 MHz) and high (26 GHz) frequency bands.

In addition to powering ultra-low latency connections, which allow downloading full-length high-quality video or movie to a mobile device in a matter of seconds (even in crowded areas), Fifth Generation or 5G would enable solutions such as e-health, connected vehicles, more-immersive augmented reality and metaverse experiences, life-saving use cases, and advanced mobile cloud gaming, among others.

The auction garnered bids worth Rs 1.45 lakh crore on the first day on July 26, with subsequent days seeing only marginal incremental demand in some circles.