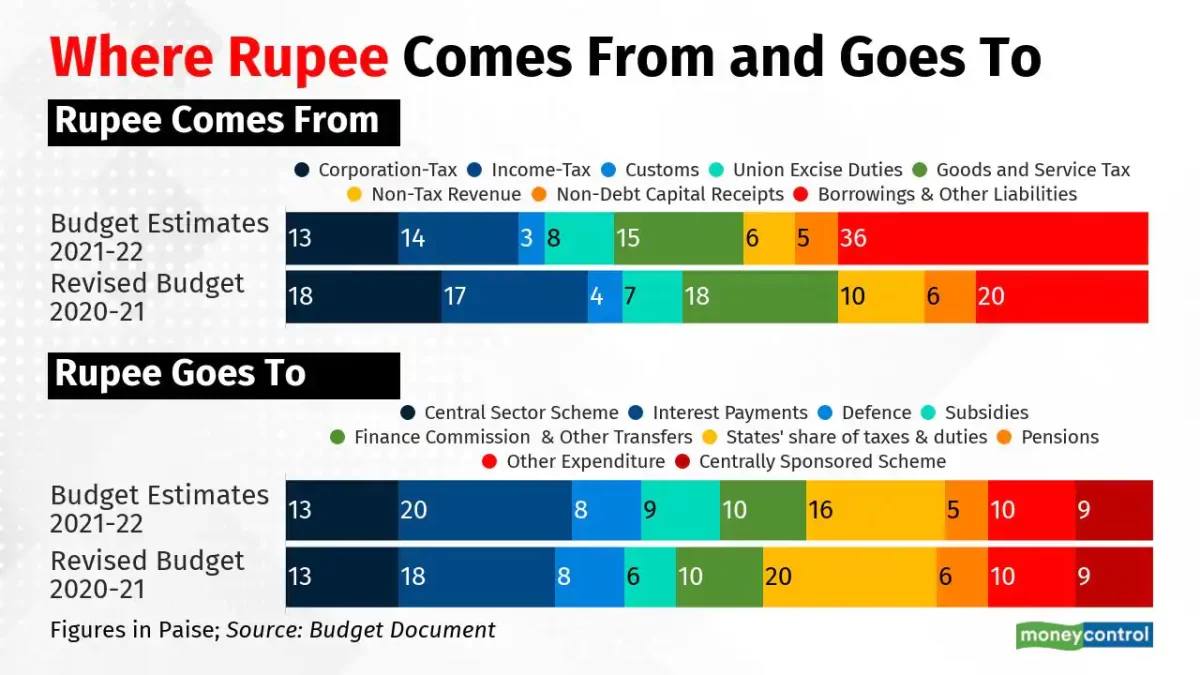

Presenting the Narendra Modi-led government’s last full budget before the next general elections, Finance Minister Nirmala Sitharaman in her speech to the Parliament today said Indian economy has grown from 10th to the 5th largest in the world in the last nine years, and per capita income of Indians has more than doubled.

Income tax slabs

Union Budget 2023-24 paves way for zero tax on income up to Rs 7 lakh, and proposed five Slabs In New Tax Regime

Rebate limit increased from Rs 5 lakh to Rs 7 lakh a year

Rs 0-3 lakh – no tax

Rs 3-6 lakh – taxed at 5%

Rs 6-9 lakh – taxed at 10%

Rs 9-12 lakh – taxed at 15%

Rs 12-15 lakh- taxed at 20%

Above Rs 15 lakh – taxed at 30%

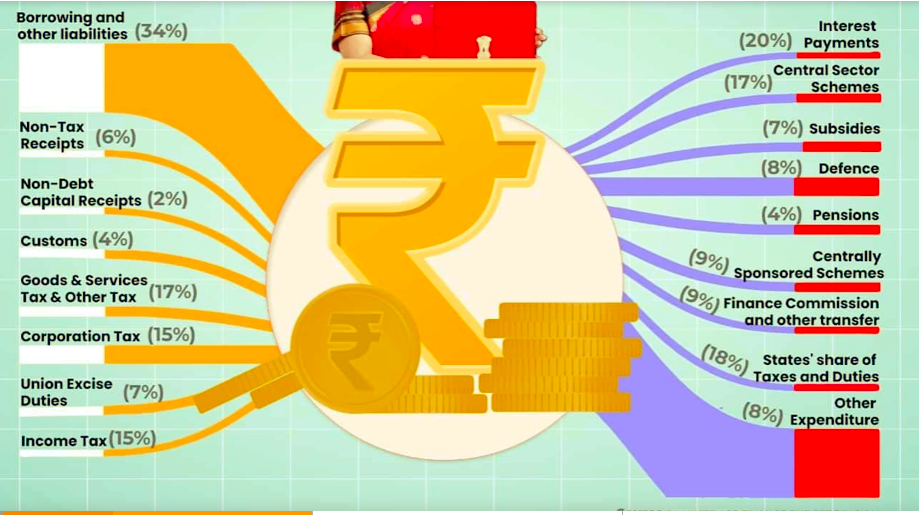

Customs Duties amended

Basic customs duty cut from 21 per cent to 13 per cent and Customs duty relief on mobile phone parts extended for another year

Reduced customs duty on TV panel parts, cigarettes duty revised upwards

Provisions towards environment

Green Hydrogen Mission for reduced dependence on fossil fuel

Rs 35,000 crore for energy transition to net-zero emission goals

New “green credit” programme under Environment Protection Act

Announcements for education sector

157 new nursing colleges to be set up

Institutes of Excellence for mass teacher training

New national digital library for children

Also Three Centres of Excellence for Artificial Intelligence have been proposed to be set up in top educational institutions, said Union Finance Minister on Wednesday in her budget speech.

Announcement for startups

Agriculture accelerator funds for startups in rural areas

Carry forward of losses from 7 to 10 years since date of incorporation

100 joint commissioners for disposal of small appeals