The Supreme Court today agreed to hear on February 17 a fresh petition of a Congress leader seeking an investigation supervised by a judge against the Adani group after allegations made by the US-based Hindenburg Research.

The Apex court bench in India initially agreed to list the PIL (public interest litigation) for hearing on February 24 and later decided to hear on Friday after the lawyer pointed out that two other PILs on the Adani-Hindenburg row are listed on February 17

A bench comprising Chief Justice DY Chandrachud and Justice PS Narasimha took note of the submissions of a lawyer, representing Congress leader Jaya Thakur, that the plea needed urgent hearing.

Thakur has also sought a direction for investigating the role of the Life Insurance Corporation of India (LIC) and the State Bank of India (SBI) in investing huge amounts of public money in the FPOs (follow on public offer) of Adani Enterprises, allegedly at a much higher rate than the prevailing share price in the secondary market.

A follow on public offer is a process by which a company already listed on a stock exchange issues new shares to the investors or shareholders, usually the promoters.

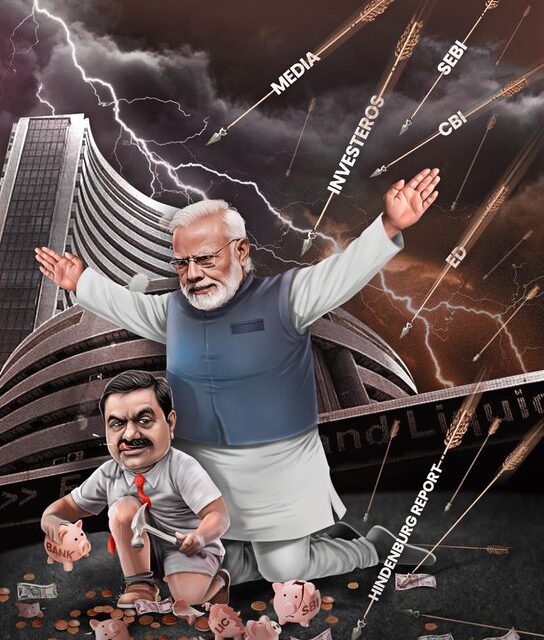

On Monday, the Union government led by BJP had agreed to the Supreme Court’s proposal to set up a panel of experts to look into strengthening the regulatory mechanisms for the stock market following the recent Adani group shares crash, triggered by Hindenburg Research’s fraud allegations.

The capital markets regulator Securities and Exchange Board of India (SEBI) in its note filed in the Supreme Court indicated it is not in favour of banning short-selling or sale of borrowed shares.

The SEBI said it is investigating allegations made by “a tiny short-seller” against the Adani group as well as its share price movements.

Adani group stocks had fallen after Hindenburg Research made a litany of allegations, including those of fraudulent transactions and share price manipulation, against the business conglomerate.

During the hearing of the two pending petitions on Monday, the union government had said the SEBI and other statutory bodies are “fully equipped” to deal with the situation.

The Supreme Court last week said the interests of Indian investors need to be protected against market volatility in the backdrop of the Adani stocks rout and told the Union government to consider setting up a panel of domain experts headed by a former judge to look at strengthening the regulatory mechanisms.