The investments of India’s largest insurance company – Life Insurance Corporation of India, made in Adani Group companies has turned negative, according to CNBC-TV18 analysis

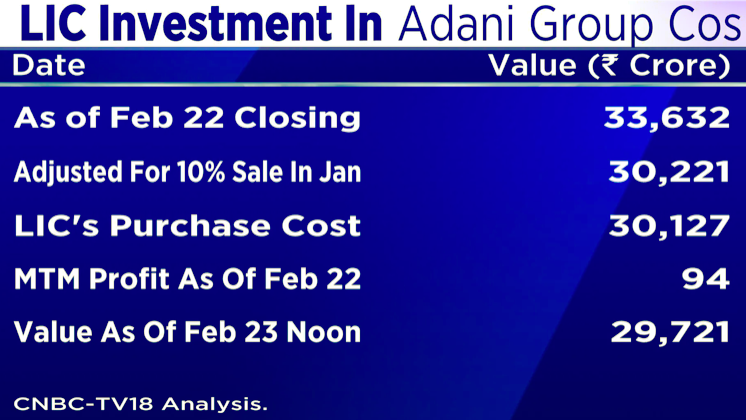

As of closing on February 22, LIC’s investment value in Adani Group companies stood at Rs 33,632 crore, as per the December shareholding pattern available on the exchanges.

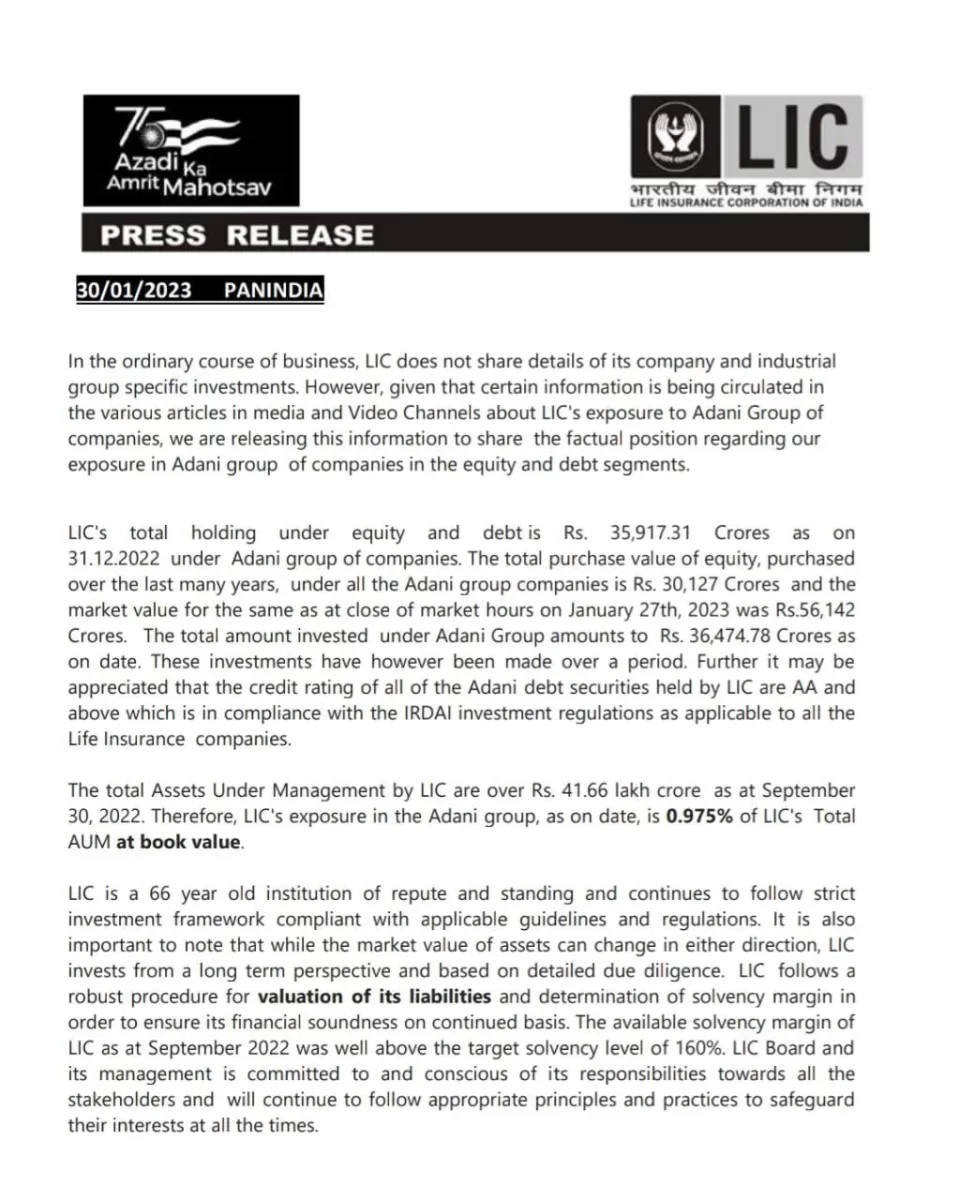

On January 27, LIC had disclosed that the value of its investments in the Adani Group stood at Rs 56,142 crore.

The same value, if calculated as per the December shareholding data comes up to Rs 62,550 crore – a difference of Rs 6,408 crore, or a little over 10 percent.

This gives rise to an important question on whether LIC sold shares of the Adani Group worth Rs 6,400 crore or a little over 10 percent of its holdings between January 1 – January 24.

Considering the December shareholding pattern, the value of LIC’s investment in the Adani Group companies stood at Rs 33,632 crore as of closing on February 22.

Extending the point of LIC selling around 10 percent of its holding in Adani Group companies, and adjusting it to the values of its investments as of February 22, the revised market value would stand at Rs 30,221 crore.

CNBC-TV18 said they have written to LIC for a response and is awaiting a comment.

On comparing the February 22 closing rates to LIC’s total purchase cost of Rs 30,127 crore in Adani Group companies, the insurer was still sitting on mark-to-market gain of Rs 94 crore.

But with Feb 23 rd fall fall, the value of LIC’s investments has declined by another Rs 500 crore, pushing LIC into a loss on its investment.

Since January 24, the day US-based Hindenburg Research released its report on Adani Group, alleging fraud, the Gautam Adani-led group has seen its market cap slide by over Rs 12 lakh crore, a fall of more than 60 percent from the peak.

The fall in share price drew concerns over the exposure of LIC and other state-run entities to the group.

In an interaction with CNBC-TV18, LIC MD & CEO Siddhartha Mohanty said that the Adani Group investment is within their prudent norms.

Finance Minister Nirmala Sitharaman also conveyed the same thought in an interview to Network18 that the investments of both LIC and SBI in the Adani Group are within permissible norms.

But reality of market conditions with in 2 weeks speaks different facts all together that cause major embarrassment to BJP Finance Minister and LIC head