To mitigate any economic fallout on financial liquidity due to Covid-19 pandemic, the Reserve Bank of India on Friday announced a set of new measures including a reduction in reverse repo rate.

Under the Reverse Repo Rate, banks deposit excess funds with the RBI and earn interest for it.

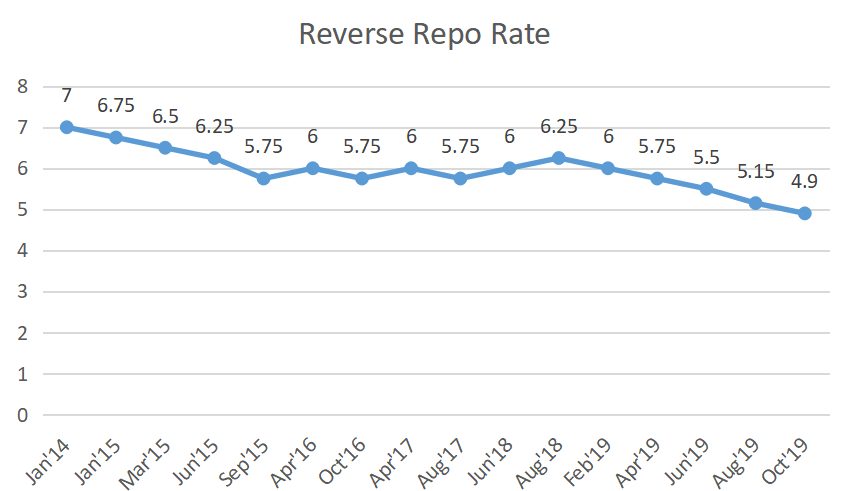

Accordingly, the rate now stands at 3.75 per cent of LAF. The reverse repo is an important monetary policy tool used by the Reserve Bank to control liquidity and inflation in the economy.

RBI reverse repo rates during the last six years period

Liquidity Adjustment Facility (LAF) is a tool used in monetary policy, primarily by the Reserve Bank of India (RBI), that allows banks to borrow money through repurchase agreements (repos) or for banks to make loans to the RBI through reverse repo agreements.

The move is expected to encourage banks to ease lending and investments into the economy.

Announcing the slew of measures via online channels, RBI Governor said that policy repo rate would for now be maintained at 4.4%.

With regard to other measures, Das said RBI will begin with giving an additional Rs 50,000 crore through targeted long-term repo operation (TLTRO) to be undertaken in tranches.

Besides, he announced a re-financing window of Rs 50,000 crore for financial institutions like Nabard, National Housing Bank and Sidbi.

RBI Governor further said surplus liquidity in the banking system has increased substantially as result of central bank’s actions.

CPI infaltion for March declined by 70 bps to 5.9 percent. This is however, based on data gathered up to March 19. The data showed softening of food inflation by around 160 bps on account of easing of prices of vegetables, eggs, pulses, meat, fish, etc. In other categories of CPI inflation pressure remain firm said RBI Governor Shaktikanta Das

RBI has injected 3.2 percent of GDP into the economy to tackle liquidity situation, Das added

This is the second time that the governor addressed the media since the nationwide lockdown was imposed from March 25.