Paytm’s parent firm had raised $30 million from SAIF Partners, Intel Capital, Silicon Valley Bank and SAP Ventures among others since 2007. In 2010, the company had filed for an initial public offering but shelved the plan after receiving regulatory clearance

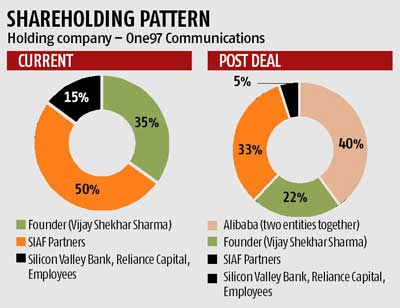

Alibaba and its payment unit Alipay together would have close to 40 per cent equity holding in Paytm once the investment of $575 million was completed, said the founder of PayTM Sharma some 3 years back

After chinese Alibaba entry make in India payTM Sharma’s equity holding in Paytm will come down to 22 per cent from 35 per cent.

One year before Modi government demonetisation the Reserve Bank of India had awarded ‘in-principle’ approval to Sharma, the founder of One97 Communications, to set up a payments bank.

Now One97 Communications, the parent entity of India’s largest digital payments firm, Paytm, has received $300 million (Rs 21.79 billion) in fresh funding from Berkshire Hathaway Inc. The deal is the Warren Buffett-led firm’s first investment in the country.

According to regulatory filings sourced from Paper.vc, One97 Communications issued 1.7 million shares to BH International Holdings on September 27. Post the investment, Berkshire Hathaway will have around 2.9 per cent holding in the Indian firm.

The investment comes at a time when Paytm is going up against global giants Google and Facebook-owned WhatsApp. Both the US giants have either launched or are in the process of launching their digital payment products built on top of India’s indigenous payment system UPI.

Google Pay (previously Google Tez) is already one among the most used UPI payment apps in the country. In August, the Mountain View company said its payment app had been downloaded over 50 million times in India. WhatsApp continues to await the go-ahead from RBI to launch its UPI service beyond the one million beta users who already have access to it.

The Facebook-owned instant messaging app has over 200 million monthly active users in India already, and experts say with such a large user base, it could really disrupt other large players in the market.

Sharma who shared his entity to Chinese Alibaba , has been quite vocal in his opposition to these global players, even calling Facebook the most evil company in the world

The other large backers of Paytm include China’s e-commerce giant Alibaba and Japan’s Softbank, both of which have pumped in billions into the digital payments firm. Alibaba has also made a separate investment into Paytm Mall, which is the e-commerce subsidiary of the Sharma-led company.