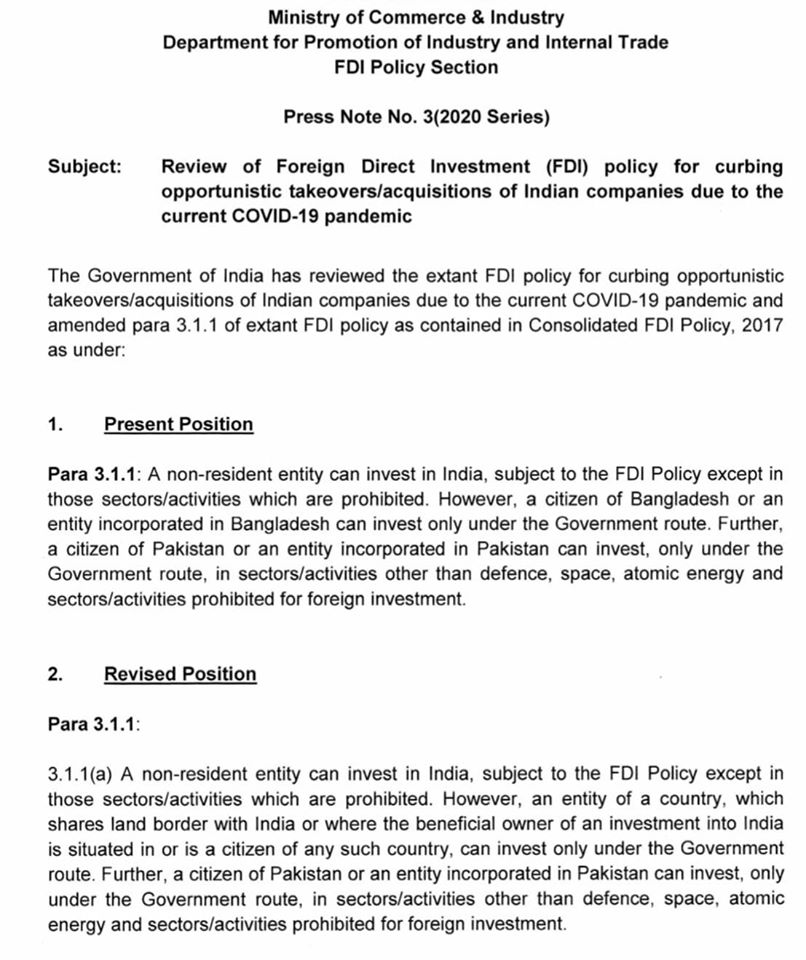

In a major change in its foreign direct investment (FDI) policy, India has brought in revised measures to curb the ‘opportunistic takeover’ of Indian companies due to the current Covid-19 pandemic by firms in neighbouring countries, including China.

According to the Press Note 3 issued by the Department for Promotion of Industry and Internal Trade (DPIIT) on Saturday, the government has said that an entity of a country which shares a land border with India can invest only after receiving government approval.

“However, an entity of a country, which shares a land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country, can invest only under the Government route,” says the note.

The new rules will also apply to ‘the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly,’ the DPIIT has said.

Hours after the centre’s move, Congress MP Rahul Gandhi tweeted his thanks to the government for “taking note” of his “warning” over possible threats to weakened Indian firms amid the pandemic.

“I thank the Govt. for taking note of my warning and amending the FDI norms to make it mandatory for Govt. approval in some specific cases,” Mr Gandhi tweeted today.

It should be noted he forewarned and On April 12, and he tagged that tweet which read as “The massive economic slowdown has weakened many Indian corporates making them attractive targets for takeovers. The Govt must not allow foreign interests to take control of any Indian corporate at this time of national crisis.”

The government, according to press note 3, would like to evaluate Chinese investment on a case-to-case basis,” said Atul Pandey, partner at law firm Khaitan & Co.

Chinese investment was allowed under the automatic route, but for in sensitive areas like telecom, defence and national security etc., he added.

The Chinese have stakes in several Indian start-ups: Flipkart has an investment from Tencent (about 5 per cent) and Alibaba owns a significant stake in Paytm.

A fresh infusion of funds in these or Chinese firms wanting to exit their existing investments will now have require government’s approval, said Pandey.

The pitch for curbing Chinese investments in India picked up pace recently after People’s Bank of China (PBoC) increased its shareholding in Housing Development Finance Corporation (HDFC) amid a sharp correction in shares of India’s largest mortgage lender.

Historical investments from China remain a low $ 2.3 billion as of December, 2019 despite the government’s push to seek more capital from the cash-rich neighbour.