A founding member of the bourse, Chitra Ramkrishna helped shape it into the world’s largest derivatives exchange, opening trading to a growing middle class and serving as its first female chief.

In 2016, she stepped down to high praise for her “sterling contribution.”

But the reputation of the woman nicknamed “Queen of the Bourse,” along with the multi-billion dollar exchange, took a shocking tumble last month.

Indian authorities accused Ramkrishna of crimes ranging from evading taxes to, more bizarrely, leaking confidential information for years to an unnamed spiritual guru living in the mountains.

The strange tale of mysticism-meets-technology reveals what could be a complete breakdown of security and best practices at the nation’s largest bourse.

With the overhang of a messy investigation, bankers in India said the new allegations may not just delay the exchange’s much-awaited initial public offering, but also hurt its growing clout in the global equity market.

Over several tumultuous weeks, the authorities arrested Ramkrishna, 59, and Anand Subramanian, her former colleague, who has also been accused of criminal misconduct.

Tax authorities searched their homes. This month, Ramkrishna’s successor and the exchange’s current chief executive, Vikram Limaye, said he would step down when his term ends over the summer.

The NSE has invited applications through March 25 for a new leader.

“Our credibility is at stake,” Sanjeev Aggarwal, a judge, said this month at a court hearing in New Delhi. “Who will invest in India if scams like this happen?”

The NSE did not respond to requests for comment. In a statement, the exchange said it was cooperating with investigators and had made management changes in recent years.

Lawyers for Ramkrishna and Subramanian did not return messages and calls seeking comment.

The pair have denied wrongdoing in court. Ramkrishna told regulators that nothing untoward happened with the guru, likening their conversations to “informal counsel from coaches, mentors or other seniors in this industry.”

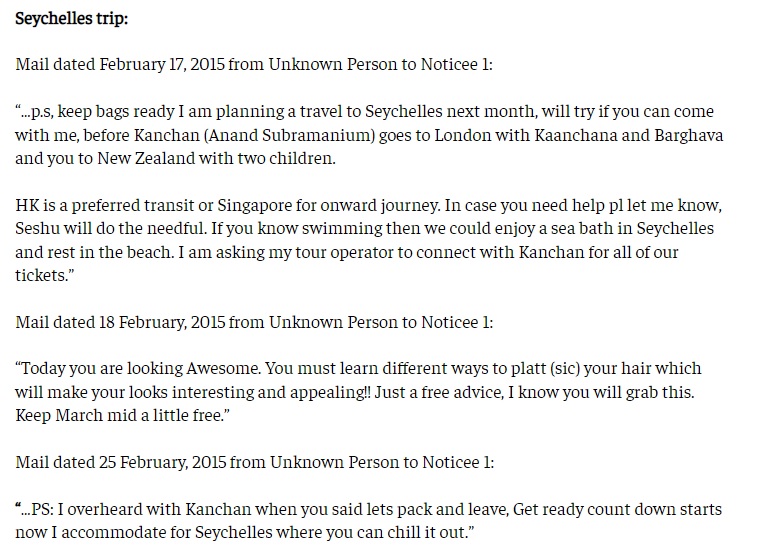

The drama intensified in February, when the Securities and Exchange Board of India released a 190-page regulatory order disclosing that Ramkrishna had sent sensitive information to an outsider described as a yogi in the Himalayas.

In an interview for that report, Ramkrishna said the figure guided her hand as chief executive, a role she served in from 2013 to 2016. The yogi was non-corporeal, she said, but corresponded using the email address rigyajursama@outlook.com, which combines the names of three religious texts. Ramkrishna referred to the guru as “thee,” “swami ji” and “your lordship.”

SEBI alleged that the yogi had turned Ramkrishna into a “puppet,” remotely controlling finances and steering promotions.

In 2013, for instance, she hired Subramanian, though, SEBI said, he had no experience in capital markets.

He was later promoted to chief operating officer at the advice of the yogi, according to the report. Employees said Subramanian had enormous influence. One Indian news outlet referred to him as a “modern-day Rasputin-like figure.”

The identity of the yogi has become a key pressure point, dividing the country’s authorities and deepening the mystery of what happened behind closed doors.

Among the most touted theories is that Subramanian was actually the yogi and that he had duped Ramkrishna, a conclusion made by Ernst & Young, which was hired by the exchange to investigate.

SEBI contested that claim, writing in the 190-page order that there was still “no conclusive evidence” linking Subramanian to the email address.

Using information from that inquiry, Indian officials have also widened another investigation potentially implicating Ramkrishna and Subramanian in facilitating unfair trading access. The incident is known locally as the “co-location scam.”

Many now wonder what regulators, NSE board members and investors did to avert malpractice, and whether issues at the exchange are more systemic than they had previously seemed.

Through a lawyer, Subramanian denied this month that he was the yogi. SEBI did not return requests for comment.