Despite drop in share prices by 50 to 100 per cent, Life Insurance Corporation of India (LIC) increased its stake in four Adani firms.,

Adani Green Energy (AGEL),

Adani Total Gas (ATGL),

Adani Enterprises (AEL) and

Adani Transmission (ATL) during the March 2023 quarter.

Even though the stake increase is minor, it comes in the quarter when US-based short-seller Hindenburg Research published its scathing report and LIC’s huge exposure in Adani firms became a talking point.

The highest increase in stake by the state-run insurer was seen in Adani Green Energy and Adani Total Gas, the two Adani stocks that witnessed maximum erosion in value after Hindenburg accused the port-to-power conglomerate of stock price manipulation.

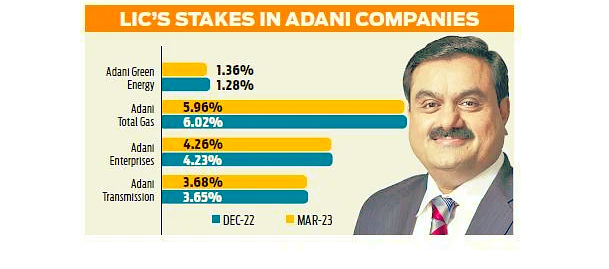

As per the exchange data available with Trendlyne, LIC, by March 2023 quarter-end, had a 1.36 per cent stake in AGEL.

This was 8 basis points (bps) higher than the 1.28 per cent stake as of December 31, 2022.

LIC’s stake in ATGL grew by 6 bps to 6.02 per cent in March quarter as against 5.96 per cent at the end of December quarter.

In AEL and ATL, LIC’s stake grew by 3 bps each sequentially.

The country’s largest institutional investor held 4.26 per cent stake in AEL as of March-end against 4.23 per cent in the December quarter.

In ATL, LIC upped its stake to 3.68 per cent from 3.65 per cent during the three-month period.

LIC stake remained stagnant at 6.41 per cent in ACC. However, it reduced its exposure in Ambuja Cements, from 6.33 per cent in December 2022 to 6.305 in March 2023.

In Adani Ports and Special Economic Zone, LIC’s holding came down to 9.12 per cent from 9.14 per cent. It is not known whether the share transactions took place before or after the release of the Hindenburg report on January 24, 2023.

In about a month after the report, LIC’s investment value in Adani firms took a beating of nearly Rs 50,000 crore and for a small period, the return had turned negative.

LIC shares performance for the past 12 months in Indian share market

LIC’s investment in Adani Group firms stood at Rs 30,127 crore at the end of January 2023. LIC’s high exposure in Adani stocks is widely criticised by Congress leader Rahul Gandhi and TMC leader Mahua Moitra.

with in a month ince the explosive Hindenburg Research report released late January. Billionaire Gautam Adani-led Adani Group’s market capitalisation (mcap) has slipped below $100 billion on Monday, tumbling over $135 billion

The conglomerate has seen an overall mcap erosion of around $200 billion from the peak of $290 billion seen in September last year.

The largest pension fund in Norway, KLP, recently sold all of its interests in the renewable energy division of the Adani Group, Adani Green Energy Ltd, over worries that the stock may have unintentionally assisted in funding some of the most polluting activities in the world.

Adani is using stock from its Green firms as security in a credit arrangement that is helping to finance the Carmichael coal mine in Australia, through Adani Enterprises Ltd., according to a public filing issued on February 10.

KLP has blacklisted coal from its portfolio, so any indirect financing of the Carmichael project would represent a “breach of our commitments,” Kiran Aziz, KLP’s head of responsible investing, said in an interview to Bloomberg.

“Investments in other parts of the adani group are leaking into the funding of Carmichael,” said Ulf Erlandsson, chief executive of Anthropocene Fixed Income Institute, which has been tracking the Adani Group since mid-2020. “Investors who have restrictions on funding greenfield thermal coal mining should revisit potential exposures across the whole of Adani Group.”