Exports bounced back in October after a contraction in September, as engineering goods, pharmaceutical and chemical shipments picked up pace.

However, this didn’t prevent trade deficit from widening, as crude oil bill continued to shoot up.

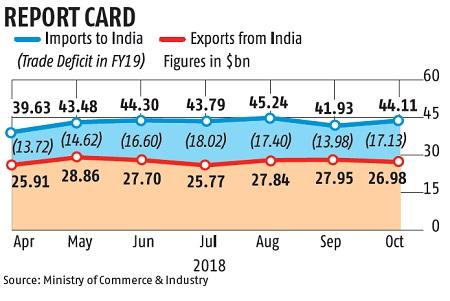

Outbound trade rose by 17.86 per cent in October to $26.98 billion. In September, exports had declined for the first time this financial year, by 2.15 per cent.

However, the latest rise failed to stop the widening trade deficit, which in October rose to $17.13 billion, compared to $13.98 billion in September, as the pace of import growth picked up again.

This was largely led by growing crude oil imports, which in October rose by 52.64 per cent, and raking up a $14.2-billion crude oil import bill.

This was up from the corresponding figure of $10.91 billion in September when imports had risen by 33.59 per cent.

Global crude prices have started reducing from early November and a supply glut is expected as sanctions hit continue to pump out oil, while the US adds fracking capacity.

India’s current account deficit (CAD) is expected to triple to a substantial $19-21 billion in Q2 of FY19, or about 3 per cent of the GDP, from the modest $7 billion in Q2 last fiscal year, according to Aditi Nayar, principal economist at rating agency, Icra.

“The softening of crude oil prices in the ongoing month has eased concerns regarding the size of India’s CAD. Assuming that the price of the Indian basket of crude oil averages $73/barrel in FY19, the CAD is forecast by Icra at 2.7 per cent of the GDP,” she added.

The second largest component of the import bill gold saw a sharp drop in inbound shipments as imports fell by nearly 43 per cent to $1.68 billion.

The gold industry continues to see volatility as imports had risen in July after remaining in negative territory for six consecutive months.

Imports of the shiny metal had remained low since the Rs 143-billion Nirav Modi scam earlier this year.

The growth of non-oil non-gold merchandise imports also remained in double digits in October, rising by 11.77 per cent to $28.21 billion as inputs, such as machinery, coal, chemicals, fertilizers, iron and steel, non-ferrous metals, and electronic goods, continued to pour in.

Receipts from processed petroleum exports swelled by nearly 50 per cent to $4.54 billion.

Growth in another major export earning sector — gems and jewellery — returned as shipment managed to rise by 5.48 per cent after a 21 per cent drop in the previous month. The sector had returned to the growth charts in June after months of contraction.

Among other major sectors, engineering goods exports rose by 9 per cent to ship out merchandise worth $6.37 billion, after a contraction of 4.12 per cent in September.

On the other hand, pharmaceutical exports picked up steam, growing by 12.83 per cent to $1.51 billion, up from the 3.83 per cent rise in the previous month.

However, signs of built-up stress reducing in the labour-intensive sector of apparels were visible in October when it zoomed upwards by 36.26 per cent.

Export of readymade garments rose to $1.13 billion after witnessing a downturn since October 2017.

Federation of Indian Export Organisations President Ganesh Kumar Gupta reiterated his demand for augmenting the flow of credit to the broader export sector as sharp decline in credits continue. Overall, of the 30 major product groups, 22 recorded growth in October.