The Indian union government offers various Small Saving Schemes to cater to the investment needs of every section of the society.

One such scheme is the National Savings Certificate (NSC), which can fetch good returns while providing the benefit of tax savings. This scheme can be purchased at any post office across the country.

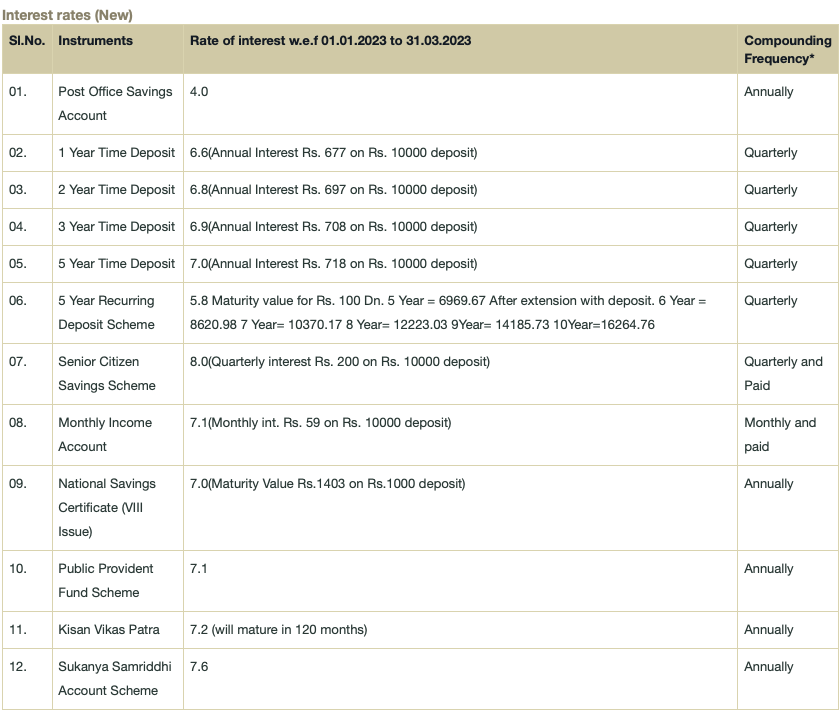

The government has recently increased the interest rate on NSC from 6.8% to 7% till December 2022.

For the quarter ending March 31, 2023, the government has raised the interest rate for the Senior Citizen Savings Scheme (SCSS) to 8%

Apart from the attractive returns, NSC also offers tax-saving benefits.

With March marking the end of the financial year 2022-23, this is your last chance to plan your tax-saving investments. Under Section 80C of the Income Tax Act, investors can avail of tax exemption of up to Rs 1.5 lakh by investing in NSC.

You can start investing in NSC with just Rs 1,000 and there is no maximum limit for investment in this scheme.

People prefer NSC over fixed deposits as it offers better returns. The maturity period of this scheme is 5 years, and you can purchase a certificate for any amount above Rs 1,000 at any post office.

NSC offers three types of investment options: single, joint, and joint with survivorship.

Single investment refers to an individual investing in the scheme, whereas two investors can jointly invest in the scheme. In the joint with survivorship option, two people invest together, but only one person receives the maturity amount.