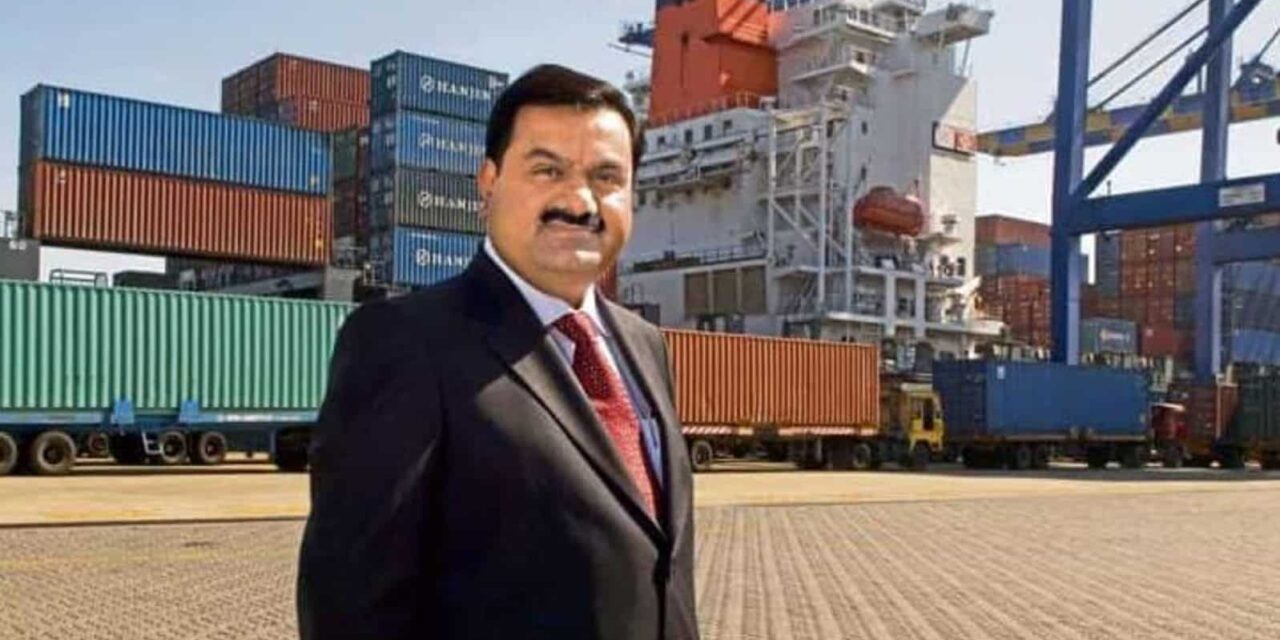

Gujarat base Adani Group has approached the State Bank of India (SBI) for a loan worth Rs 14,000 crore to build a new plant in Mundra in Gujarat.

The new facility is being planned to manufacture polyvinyl chloride (PVC) from coal, a Mint report stated. State-run SBI has approved a loan of Rs 14,000 crore to Gautam Adani, the richest man in India and Asia.

A loan has been asked by the Adani Group for the development of a PVC plant in Mundra, Gujarat.

The total cost of setting up the project is expected to be around Rs 19,000 crore.

The plant is expected to be a part of Adani Group’s plans to develop a petrochemical cluster at Mundra. It will have a production capacity of 2,000-kilo tons per annum (KTPA) and will make products like emulsion PVC, suspension PVC and chlorinated PVC.

The company, in its annual report for 2021-22, had stated that a total capacity of 2 million metric tonnes of PVC will be developed at Mundra, in a phased manner. The 2,000 KTPA project will be completed in the first phase and is expected to be commissioned by 2024.

The application for the PVC plant comes just days after Adani Group secured a loan worth Rs 6,071 crore for a new copper refinery at Mundra, on June 26. It was secured by one of the subsidiaries of the group, Kutch Copper Limited.

In March, the Gautam Adani-led group also secured a Rs 12,770 crore loan for a greenfield international airport project at Navi Mumbai from SBI.

The loan was taken by Navi Mumbai International Airport Pvt Ltd (NMIAL), another subsidiary of the group.

The loan was later underwritten by SBI and sold to other lenders. Similarly, the bank is also planning to come up with a plan to underwrite the PVC plant loan in future, retaining just Rs 5,000 crore out of the total loan amount, the Mint report stated.

In the financial year 2021-22, Adani Group’s debt grew by 40.5 percent to Rs 2.21 lakh crore. Last financial year’s figure was Rs 1.57 lakh crore. Adani Enterprises’ debt grew 155% in 2021-22, the highest in its history. There was an increase of Rs 41,024 crore in the company’s debt during this period.

It has raised eyebrows that Adani Capital and the State Bank of India have recently partnered up. Since 1991, things have been very different for the State Bank of India, which was once known as the people’s bank. SBI has seen a decline in small credit. The Reserve Bank of India has fined SBI several times, which was previously unheard of.

There has been criticism regarding the failure of SBI to refund Rs 164 crore collected from financial inclusion accounts. The Adani Group’s coal project financing in Australia has been the focus of a worldwide campaign against lending them money.