Cricket is India’s most loved game, and as millions of Indian taxpayers watch the match today,

Two Australians used the 1 ODI match where India lost to Australia .

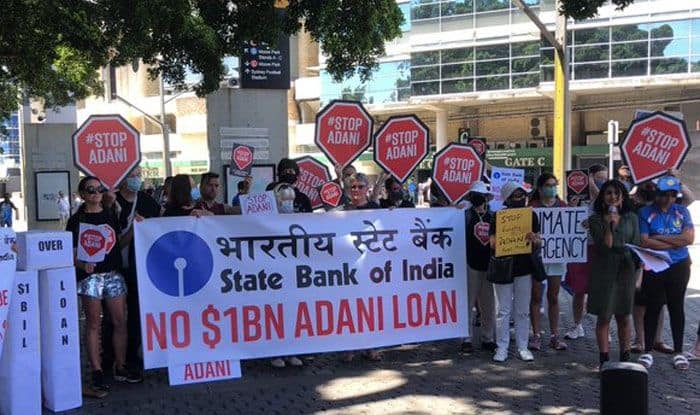

The growing public sentiment against Adani Group chairman Gautam Adani in Australia came to the fore at Sydney Cricket Ground, where the first ODI between India and Australia was being played, on Friday when two protestors holding placards which read “State Bank of India: No $1 BN Adani Loan’ made their way into the field.

One of the protesters carrying a placard even managed to invade the pitch. Both were later escorted out of the field.

The Australian protesters called on the State Bank of India (SBI) to review its decision to provide loans worth $1billion to Adani Group for its Carmichael coal mine project in Australia.

Protesters alleged that the loan would amount to handing over Indian taxpayers’ money to Adani to dig a coal mine, which no bank in the world has so far been willing to fund.

A spokesperson of the ‘Stop Adani’ campaign, Manjot Kaur, who is a university student and former school striker from the central west coal region in NSW was quoted as saying by the media that the SBI needs to ‘bowl out’ Adani’s loan and ‘swing the bat for a safe future for Indians’.

We are letting them know that the State Bank of India is at risk of handing their money to a billionaire to dig a polluting coal mine in Australia.

If you have ever been to an Indian cricket game, you will know that people of India are proud of their country and their sport. We want to make sure that Indians can be proud of their State Bank too,” said Kaur.

According to Finanical times daily “Credit Suisse warned in a 2015 “House of Debt” report that the Adani Group was one of 10 conglomerates under “severe stress” that accounted for 12 per cent of banking sector loans.

Yet the Adani Group has been able to keep raising funds, in part by borrowing from overseas lenders and pivoting to green energy.

[splco_Shortcodesspacer]

[splco_Shortcodesspacer]

The report said Adani continues to enjoy ample access to capital, both at home and overseas, and can tell investors that he has never defaulted on a loan despite highly leveraged balance sheets.

Adani Group companies tapped international debt markets with bond sales of more than $2 billion and Adani Gas sold a 37.4 per cent stake to Total for a reported $600m, which gave him ample cash flow to weather the shock of the pandemic when it hit.

And international groups are queueing up to partner with the Indian Prime Minsiter Modi’s closest friend .

Earlier this month, Adani announced a strategic collaboration in hydrogen and biogas with Italian gas and infrastructure group Snam.

But for others, Adani has become too big to fail. “He’s become one of the most powerful men in India in the space of 20 years,” Buckley says.