The resignation of Pranoy roy and his wife from the NDTV board to be recorded as take over ploy in the history of media corporate world

Splco summarises the time line of events :

The game started in august 23, 2022 when NDTV shares traded at 369 Rs Gujarat based Gautam Adani-led Adani Group acquires a 100 per cent stake in Vishvapradhan Commercial Private Limited (VCPL).

VCPL owned convertible debentures (in the form of warrants) in Radhika Roy Prannoy Roy (RRPR) Holding Pvt Ltd, which in turn owned 29.18 per cent stake in NDTV Ltd. So with the VCPL purchase, the Adani Group indirectly acquired these warrants which would give it a 29.18 per cent stake in NDTV Ltd on conversion.

In August again, VCPL notified RRPR Holding of its intention to convert these warrants (issued in 2009) into equity shares, giving the firm 99.5 per cent control. With these shares of RRPL Holding, Adani Group-controlled VCPL was entitled to 29.18 per cent stake in NDTV Ltd.

Armed with 29.18 per cent indirect stake in NDTV Ltd, Adani Group launched an open offer (under Sebi norms) to acquire an additional 26 per cent stake in the Delhi-based news channel on November 22. The open offer will close on December 5 this year.

The transfer of equity shares from RRPR Holding to VCPL was completed on Monday, November 28. NDTV’s promoter firm RRPR Holding said in a disclosure to the stock exchanges that it had transferred shares constituting 99.5 per cent of its equity capital to Adani group-owned Vishvapradhan Commercial (VCPL).

This transfer of shares will now give the Adani group direct control over a 29.18 per cent stake in NDTV.

As on Monday’s close, the exchange data showed that Adani’s open offer drew bids for 5.3 million shares, or 31.78 per cent of the 16.8 million shares on offer so far.

On Monday 28 nov , shares of NDTV were locked in a 5 per cent upper circuit on the BSE, settling at Rs 406.10 apiece.

Adani’s open offer price is Rs 294 per share, while NDTV shares settled at Rs 368.40 on the first day of open offer (Thursday), which is at a 25.3 per cent premium over the offer price.

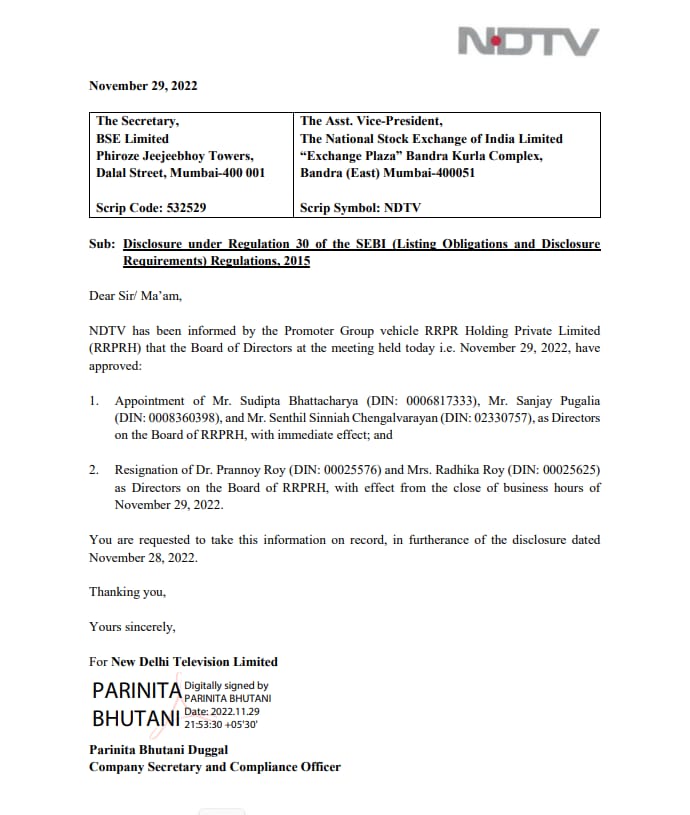

On Tuesday 29 nov NDTV letter disclose resignation of founder members and directors quit the board and three new directors taken charge imediataley.

An open offer forms part of the takeover code as defined by the Securities and Exchange Board of India (Sebi).

It is an offer made by the acquirer to the shareholders of the target company, inviting them to tender their shares at a particular price.

An open offer is triggered when a company acquires up to a 15 per cent stake in another listed entity; i.e. the acquirer must make an offer to existing shareholders to buy an additional 20 per cent stake in the target firm.

The open offer is typically kept running for about a month from the date of announcement.

The primary aim of an open offer is to provide an exit option to the shareholders of the target company upon a change in control of the target firm, or substantial acquisition of its shares.

Since the Adani Group emerged as a large shareholder with a 29.18 per cent stake in NDTV, it made an open offer to buy another 26 per cent so that the minority shareholders who wished to exit NDTV may tender their shares.

The conglomerate, run by India’s richest man Gautam Adani, acquired a little-known company in August, that lent over Rs 400 crore to NDTV’s founders more than a decade ago in exchange for warrants that allowed the company to acquire a stake of 29.18 per cent in the newsgroup at any time.

Following that, VCPL, the firm that the Adani group bought out, announced that it would launch an open offer on October 17 to buy an additional 26 per cent stake from minority shareholders of NDTV. However, the offer was delayed since Sebi had not given its approval to the open offer.

With SEBI consent made change in the control structure of NDTV become evident .

In the interview, Justifying the ambush attack on NDTV ., Gautam Adani said that the NDTV purchase was a “responsibility” rather than a “business opportunity”.

However critics in favour saving promoters position cry over the open offer price lower than the market price..

According to Sebi’s pricing formula under its takeover code, the open offer – in the case of a direct and indirect acquisition- has to be the higher of either

i) the highest negotiated price under the share purchase agreement

(ii) the volume weighted average price of a share over 52 weeks

(iii) the highest price paid by the acquirer in the 26 weeks before the announcement, or

(iv) the volume weighted average market price of the share in the 60 days preceding the announcement.

With the promoters resignation happened less than 100 days In the history of corporate world ., the events of NDTV ambush take over certainly in future alert promoters to hold their stocks in a more protective way ..