Tamil Nadu Finance Minister Palanivel Thiaga Rajan pointed out that after the GST was introduced, there was a wide gap between the actual revenue realised and the guaranteed revenue protected by the GST Act.

The pandemic exacerbated the problem, and the State’s revenues were yet to recover fully, he said at the pre-budget meeting chaired by Union Finance Minister Nirmala Sitharaman in November.

Mr. Thiaga Rajan also urged the Union government to release ₹11,185.82 crore in the pending compensation dues at the earliest and extend the compensation period by at least two years.

According to the details shared by the Tamilnadu Finance Minister at the recent Assembly session, thanks to persistent efforts, the Union had released ₹9,602 crore of the pending arrears for the previous years under GST compensation in 2022-2023.

Reserve Bank of India (RBI) released the Report titled “State Finances: A Study of Budgets of 2022-23”, an annual publication that provides information, analysis and an assessment of the finances of State governments for 2022-23 against the backdrop of actual and revised/provisional accounts for 2020-21 and 2021-22, respectively.

The theme of this year’s Report is “Capital Formation in India – The Role of States”.

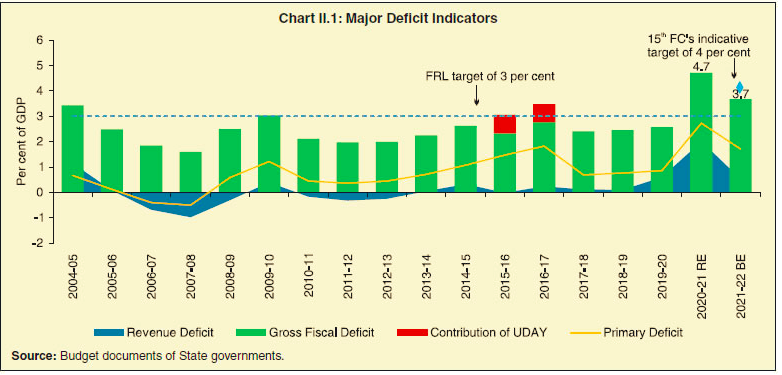

The fiscal health of the States has improved from a sharp pandemic-induced deterioration in 2020-21 on the back of a broad-based economic recovery and resulting high revenue collections

States’ gross fiscal deficit (GFD) is budgeted to decline from 4.1 per cent of gross domestic product (GDP) in 2020-21 to 3.4 per cent in 2022-23.

While Indian States’ debt is budgeted to ease to 29.5 per cent of GDP in 2022-23 as against 31.1 per cent in 2020-21, it is still higher than 20 per cent recommended by FRBM Review Committee, 2018 (Chairman: Shri N. K. Singh), warranting prioritisation of debt consolidation.

Under the ‘State Finances: A Study of Budgets of 2022-23 and the actual GST revenue, RBI’s report it said .,

In the absence of the GST compensation, the States need to augment their revenue by increasing compliance, plugging leakage and widening the tax bases, the RBI report pointed out.

Tamilnadu . received a compensation of about ₹40,000 crore. At least 10 States may fall short of the expected 14% GST growth, says the study. Puducherry, Punjab, Delhi, Himachal Pradesh, Goa and Uttarakhand likely to be most affected by the end of the compensation regime..

Tamil Nadu was among the top five GST compensation receiving States during the five-year transition period from July 2017 to June 2022, according to a study by the Reserve Bank of India (RBI).

The Goods and Services Tax (GST) was introduced on July 1, 2017 and June 30, 2022 marked the end of the transition period during which the States were compensated for any loss in revenue due to the implementation of the new tax regime, calculated as the difference between the projected revenue based on a 14% annual growth with 2015-16 as the base year.

The compensation to the States was being met through the levy of a GST compensation cess on specified goods and services, the RBI annual publication said.

The requirement for GST compensation varied widely across States, it noted.

According to the data shared in the report, Tamil Nadu received a GST compensation of about ₹40,000 crore during the transition period.

This excludes the back-to-back loans extended to States in lieu of GST compensation.

Tamil Nadu was the fourth highest compensation receiving State, after Maharashtra, Karnataka and Gujarat. Punjab stood fifth.

Owing to the impact of the COVID-19 pandemic, GST collections nosedived, and the corpus available in the GST Compensation Cess Fund was insufficient to meet the compensation demand from States, the report noted.

As a result, the Union government resorted to market borrowings of ₹1.10 lakh crore and ₹1.59 lakh crore in 2020-21 and 2021-22 respectively to provide back-to-back loans to States so as to meet the GST compensation shortfall.

However, both the principal and the interest on such borrowings were to be repaid by the Centre from the collections through the GST compensation cess, whose timeline had been extended to March 2026, it noted.

The study also noted that at least 10 States, including Tamil Nadu, Maharashtra, Gujarat, Karnataka and Uttarakhand, were expected to fall short of the expected 14% GST growth, as per the budget estimates for 2022-23.

And also , Puducherry, Punjab, Delhi, Himachal Pradesh, Goa and Uttarakhand are likely to be most adversely affected by the end of the compensation regime.

The share of GST compensation in their tax revenue had exceeded 10%, on an average.

For Tamil Nadu, the GST compensation accounted for less than 10% of the tax revenue.

Overall, the north-eastern States have been the biggest beneficiaries of the GST regime, recording a compound annual GST revenue growth of 27.5% since the implementation of the GST (2017-18 to 2022-23), as against 14.8% for all States, the RBI said.