Reuters said that the Ministry of Corporate Affairs will look into allegations against Dewan highlighted by Cobrapost. The report further said that the government had already launched its probe.

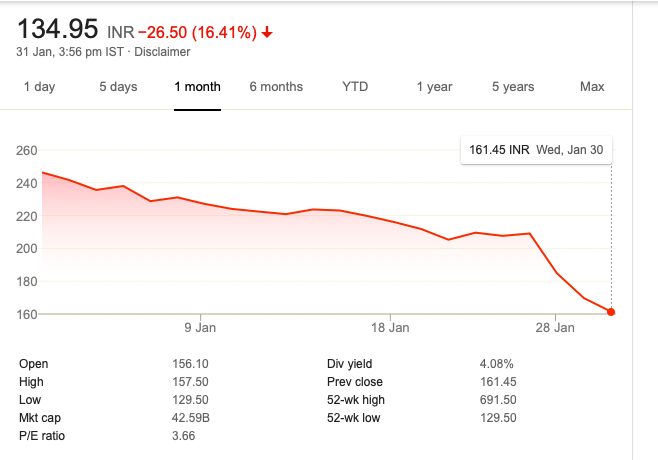

This news bought today crash, and DHFL’s shares have now tanked by 30% over the last four days. The company’s stock is now trading at its lowest level since May 2014.

The Cobrapost website had claimed it to be India’s largest scam in the country’s history adding that the company had siphoned off Rs 31,000 crore into promoter companies to create private wealth through a network of shell companies.

The website had said that DHFL had transferred around Rs 21,477 crore of funds into various shell companies as loans and investments without any terms.

Cobrapost had claimed, “Public money earmarked for slum rehabilitation disappears into shell companies. Rs 631 crore comes back after two years without any interest or dividend, some is used to buy a cricket team, another to finance a London bank.”

Experts said that the revelation will have a considerable impact on the share market. “Cobrapost has blamed the company for providing and moving funds via shell companies.

This will further dampen the company valuations and might initiate investigations into the firm. The company already is facing funding issues.

The NBFC sector will be facing even more tighter liquidity if there is an investigation or a default by DHFL. We have a ‘sell’ rating on the company and would see a gap down opening tomorrow,” Sameer Kalra – Equity Research Analyst & Founder Target Investing, was quoted by moneycontrol website on the day of the expose.

The biggest victim of this alleged scam, according to Cobrapost, are Indian banks that are already reeling under enormous stress due to scams hitting the PNB, AXIS BANK and ICICI.

Together these banks have a cumulative liability of a whopping Rs 96,880 crore. These are mostly public sector banks with the exception of Kotak, ICICI, HDFC and Axis.

Loans issued by the State Bank of India amount to Rs 11,650 crore, while Bank of Baroda and Bank of India loaned more than Rs 4,000 crores each.