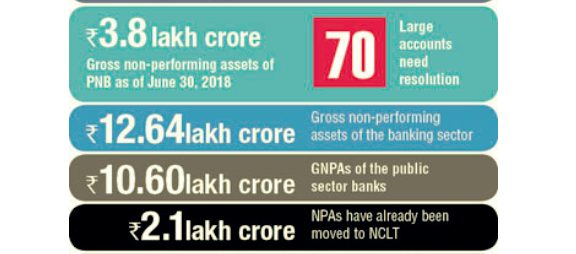

At the end of the financial year March 2018, banks had reported gross non-performing assets (NPAs) of Rs 12.64 lakh crore of this the public sector banks had gross NPAs of Rs 10.60 lakh crore. Of this, Rs 2.1 lakh crore has already moved to NCLT.

The NPAs in the Rs 50 crore and below category is about Rs 1.1 lakh crore, Rs 50 crore and Rs 500 core is Rs 3.1 crore and Rs 500 and above cases is Rs 3.1 lakh crore.

The RBI’s February 12 circular on restructuring bad loans had mandated banks to take loan accounts of Rs 2,000 crore and above which remain unresolved for over 180 days starting from March 1, 2018, to the National Company Law Tribunal (NCLT) under the Insolvency and Bankruptcy Code.

The RBI circular asks banks to identify projects with even a day’s default as stressed assets, and conclude resolution proceedings in 180 days. The circular came into effect on March 1 and the 180-day deadline concludes on August 27.

Reserve Bank of India’s (RBI) deadline for the resolution of big-ticket non-performing assets (NPA) comes to an end on 27th august , bankers will approach the central bank to deliberate on the resolution plans for select power plants which are finalised.

Power plants, including GMR Rajahmundry with a loan of Rs 2,230 crore and Jaiprakash Power Ventures, where restructuring plans are approved by a consortium of banks will be submitted to RBI for its nod.

Banks have another fortnight to take the unresolved debt to the National Company Law Tribunal (NCLT).

Most of the power loans that were expected to be resolved under the inter-creditor agreement may head to the NCLT. Some of telecom and EPC companies will also move to the tribunal.

According to a recent report by ratings agency Icra, 70 large accounts, mainly from power, EPC and telecom with a total exposure of Rs 3.8 lakh crore, would require resolution by September 1 as per the RBI’s February 12 circular.

A major portion of this debt will be 18 power plants, including big names such as Lanco Amarkantak Power, GMR Chhattisgarh, according to bankers.

Some of the power accounts are already in the NCLT. High-value loans to power projects of Jaypee, Lanco, Essar, Monnet and GMR groups are among the 34 stressed power assets that have loans of over Rs 1.75 lakh crore”Where the resolutions are nearly complete, we will be taking the cases to RBI immediately to get the regulator’s approval on restructuring,” said a senior banker.

Gujarat-based power plants such as Adani Power, Essar and Tata’s Coastal Gujarat Power are likely to have a special restructuring plan from the government.

Leading Corporates in business Industries Power and Infrastructure confirms the NPAs has rose drastically during the last four years and post demonetisation this effect found on huge upswing that worries not only banks but Industries at large