Trinamool Congress MP Mahua Moitra on Friday Questioned union government on Gautam Adani even as S&P Dow Jones said it will remove the group’s flagship firm Adani Enterprises from sustainability indices with effect from February 7 following a media and stakeholder analysis triggered by allegations of accounting fraud.

Moitra questioned why the National Stock Exchange or NSE was yet to reevaluate the index membership of Adani stocks.

“S&P Dow Jones removes Adani Enterprises from Dow Jones indices due to charges of stock manipulation & accounting fraud. Why is @NSEIndia not reevaluating index membership of Adani stocks when international ones are?” the TMC firebrand tweeted.

In another tweet, Moitra said lawyer Cyril Shroff should recuse himself from SEBI’s Committee on Corporate Governance & Insider Trading, if it’s investigating the Adani issue, as his daughter is married to Adani’s son.

“Greatest respect for ace lawyer Cyril Shroff but his daughter is married to Gautam Adani’s son. Shroff serves on SEBI’s Committee on Corporate Governance & Insider Trading. If at all @SEBI_India is examining Adani issue, Shroff should recuse himself. Perceptions are Reality,” she wrote.

On Thursday, the TMC MP had urged the insurance regulator IRDAI to keep a watch on the state-run Life Insurance Corporation (LIC), which has invested over ₹30,000 crore in ports-to-power conglomerate.

S&P Dow Jones’s move comes amid leading stock exchanges BSE and NSE putting three Adani Group companies – Adani Enterprises, Adani Ports and Special Economic Zone and Ambuja Cements under their short-term additional surveillance measure (ASM) framework.

“Adani Enterprises will be removed from the Dow Jones sustainability indices following a media and stakeholder analysis triggered by allegations of accounting fraud,” S&P Dow Jones Indices said in a statement.

It will make the changes to the Dow Jones sustainability indices, effective prior to the opening on February 7.

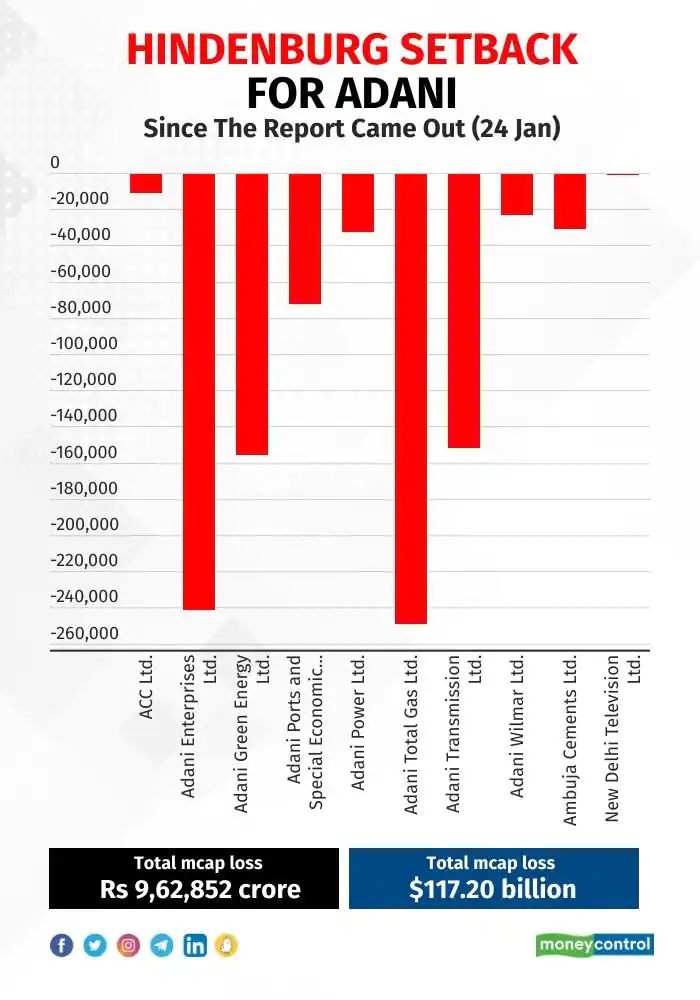

Shares of Adani Enterprises were trading 15 per cent lower on the BSE in the morning trade on Friday. The counter had plunged over 26 per cent on Thursday and more than 28 per cent on Wednesday.