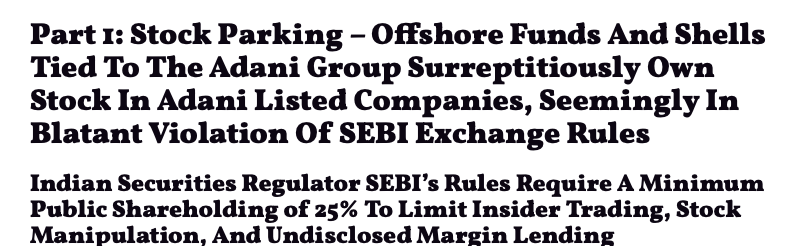

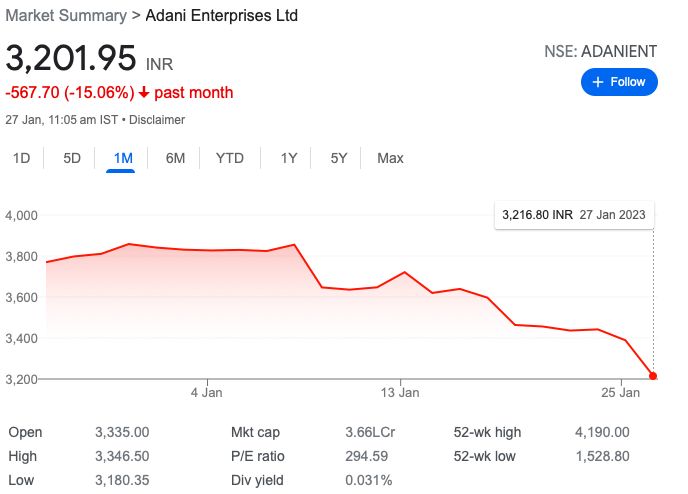

Adani Group stocks continued to be in a free fall on Friday as the spat between Gautam Adani-led group companies and US activist investor Hindenburg Research took stock market Investors by surprise

Shares of the group’s flagship company Adani Enterprises tumbled 6.2 per cent to Rs 3,180 per share in early deals,

While those of Adani Ports and SEZ shed 5 per cent; Adani Power 5.3 per cent; Adani Wilmar 4.9 per cent; Ambuja Cement 4.6 per cent; Adani Green 15.5 per cent; and Adani Total Gas 19.6 per cent. By comparison,

Also the benchmark S&P BSE Sensex plunged 578 points or nearly 1 per cent at 9:30 AM.

“The volatility in Indian stock markets created by the report is of great concern and has led to unwanted anguish for Indian citizens. We are deeply disturbed by this intentional and reckless attempt by a foreign entity to mislead the investor community and the general public, undermine the goodwill and reputation of the Adani Group and its leaders, and sabotage the FPO from Adani Enterprises. We are evaluating the relevant provisions under US and Indian laws for remedial and punitive action against Hindenburg Research,” he said in a statement.

However, responding to the legal threat, Hindenburg Research said it stands by its report, adding that it has a long list of documents it will demand in a legal discovery process.

“In the 36 hours since we released our report, Adani hasn’t addressed a single substantive issue we raised… At the conclusion of our report, we asked 88 straightforward questions that we believe give the company a chance to be transparent. Thus far, Adani has answered none of these questions,” the firm said in a tweet.

The slide in Adani group stocks comes after the shares faced a $12-billion wipe out on Wednesday.

Short-seller Hindenburg Research said that day that it held short positions in Adani Group companies through US-traded bonds and non-Indian-traded derivative instruments.

The seven listed companies of the Adani group, which is controlled by world’s third richest man Gautam Adani, have an 85 per cent downside on a fundamental basis due to sky-high valuations, Hindenburg had said in the report.

“Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing,” Hindenburg said.

Adani Group’s total gross debt in the financial year ending March 31, 2022, was Rs 2.2 trillion.

Of this, bank debt (term loans, working capital and other facilities) forms just 38 per cent of the total debt, while bonds/CP (commercial paper) constitute 37 per cent, 11 per cent is borrowing from financial institutions, and the remaining 12-13 per cent is inter-group lending.

“While debt levels have doubled from Rs 1 trillion to Rs 2 trillion in the past three years, bank debt has increased by more than 25 per cent.

Those bank has exposure to Adani groups has had the hit The Nifty Bank index fell 2 per cent on the National Stock Exchange (NSE) on Friday dragged by ICICI Bank (down 3 per cent), Bandhan Bank (2 per cent), HDFC Bank (1.9 per cent), Axis Bank (1.8 per cent0, and SBI (1.8 per cent).

Nonetheless, Adani stocks are likely to continue under pressure due to the fallout from the Hindenburg report.

The elevated valuations of Adani stocks are a serious concern, said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.