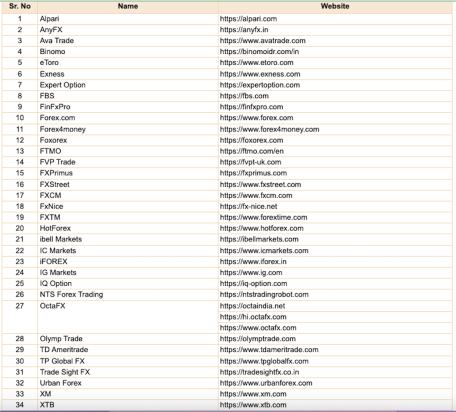

The Reserve Bank of India recently issued an “” comprising names of apps and entities that have not been authorised to deal in forex and to operate electronic trading platforms for forex transactions.

The ‘alert list’ is not exhaustive, says the RBI, adding that it is based on what was known to the RBI till September 7, 2022.

The central bank’s list of such unauthorised entities includes Alpari, AnyFX, Ava Trade, Binomo, eToro, Exness, Expert Option, FBS, FinFxPro, Forex.com, Forex4money, Foxorex, FTMO, FVP Trade, FXPrimus, FXStreet, FXCM, FxNice, FXTM, HotForex, ibell Markets, IC markets, iFOREX, IG Markets, IQ Option, NTS Forex Trading, OctaFX, Olymp Trade, TD Ameritrade, TP Global FX, Trade Sight FX, Urban Forex, XM and XTB.

Notably, London-based OctaFX, which the RBI says is not authorised to deal in forex, was also one of the official sponsors of the Delhi Capitals team in the Indian Premier League (IPL) this year, say media reports. Ads of many such platforms can also often be seen on popular social media platforms including YouTube.

Many unauthorised platforms lure people by promising lofty returns on investment. However, using such platforms is not just risky but may also land the users in legal trouble.

Users of these unauthorised platforms may be prosecuted, according to RBI.

“Members of the public are once again cautioned not to undertake forex transactions on unauthorised ETPs or remit/deposit money for such unauthorised transactions. Resident persons undertaking forex transactions for purposes other than those permitted under the FEMA or on ETPs not authorised by the RBI shall render themselves liable for legal action under the FEMA,” the RBI said in a statement dated 7th September 2022.

The central bank said that the above list is not exhaustive and is based on what was known to the RBI at the time of publication. It said that any entity not appearing in this list should not be assumed to be authorised by the RBI.

To check more details on authorised franchises click for RBI link : https://rbi.org.in/Scripts/franchisees_List.aspx

According to RBI, resident persons should undertake forex transactions only with authorised persons and for permitted purposes, in terms of the FEMA (Foreign Exchange Management Act, 1999).

RBI website confirmed ” Permitted forex transactions executed electronically should be undertaken only on electronic trading platforms (ETPs) authorised for the purpose by the Reserve Bank of India (RBI) or on recognized stock exchanges (National Stock Exchange of India Ltd. (NSE), BSE Ltd. (BSE) and Metropolitan Stock Exchange of India Ltd. (MSE)) as per the terms and conditions specified by RBI from time to time”

Also according to RBI as per FEMA, resident persons are not permitted to undertake forex transactions on unauthorised ETPs.

The list of authorised ETPs is available here https://m.rbi.org.in/scripts/bs_viewcontent.aspx?Id=4080