Allowing borrowers more time to repay loans, the Reserve Bank of India (RBI) on Friday extended the moratorium on EMI payments by another three months, till August-end, taking the total moratorium period to six months.

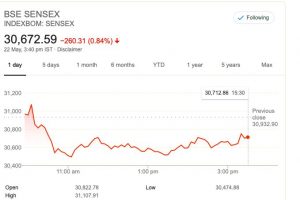

In addition the central bank has increased group exposure limits of lenders from 25% to 30% and RBI also extended the deferment of interest payment on working capital loans till August 31. However SENSEX fail to react use of offers , and dropped 260 points ( -0.84%)

On March 27, the RBI had provided a three-month moratorium on all term loans (from March 1 to May 31).

Reacting to the soaps offered by RBI Firms had earlier expressed concern over having to pay the deferred interest in one shot as soon as the moratorium ends.

Addressing this, the RBI asked lenders to convert the accumulated interest on working capital facilities over the deferment period into a funded interest term loan “which shall be repayable not later than the end of the current financial year”.

The RBI also said rescheduling of payments on account of the moratorium or deferment will not qualify as default.

In nut Sheel what it means is there will also be a standstill in asset classification for all accounts, which were standard as of March, 2020, and opted for the moratorium.

Reacting to this State Bank of India Chairman Rajnish Kumar said around 20 per cent of the bank’s customers have availed of the moratorium facility.

Customers are seeking the moratorium not just because of cash flow issues, but also to preserve cash, he said.

Bankers asked for an extension in moratorium because “nobody had expected that the lockdown will be extended for such a long period”, he added.

On the issue of moratorium to shadow lenders, Kumar said for NBFCs and HFCs, the requirement for funds would depend on their outflows.

“Banks will extend the moratorium on a case-by-case basis.” He said there are enough government and RBI measures to support them.

S S Mallikarjuna Rao, MD & CEO, Punjab National Bank, said the moratorium extension was expected. “It looks sufficient at this point of time.”

Axis Bank has around 25-28 per cent of its loan book under moratorium as of April, while for ICICI Bank, about 32 per cent of the customers by value both retail and corporate have taken the option.

As of April-end, 26 per cent of Kotak Mahindra Bank’s borrowers by value at account level have opted for the moratorium, while 71 per cent of Bandhan Bank’s loan book by value is under the moratorium.

Hardika Shah, founder & CEO, Kinara Capital, said, “The moratorium could be effective if it is also extended to NBFCs. Clarity on this from the RBI is still lacking.”

How one-time restructuring ie perceived by Banks

State Bank of India Chairman Kumar said this is required when enterprises incur losses. “The moratorium takes cares of the situation around the cash flow disruptions.

And if someone needs restructuring after August 31, then banks have to deal with it. We should not be obsessed with one-time restructuring at this point as we have time till August 31 to see how the various sectors respond after the lockdown is lifted.”

Punjab National Bank Rao said restructuring is required, but without understanding cash flows, that exercise will serve no purpose.

“In the second half, banks will be better positioned to make an assessment on non-performing assets and capital requirements.”

[splco_spacer size=”30″]

[splco_spacer size=”30″]

Center bank announcements leads to NPAs dilemma amongst banks

The central bank has also relaxed provisioning norms in cases where large accounts have defaulted and no resolution plan has been implemented even after 210 days.

It gave an extension for resolution of such assets. The RBI has permitted banks to exclude the moratorium period from the calculation of 30-day review period or 180-day resolution period.

Lenders have been also asked to “recalculate their drawing power” in the case of working capital loans by reducing their margins till August 31 which can be restored by March 31, 2021.

The RBI also allowed banks to reassess the working capital cycle of a borrowing entity till March 31, 2021.

CRISIL said “the continuation of standstill provision for NPA recognition till August will provide an interim relief to lenders.”

But, the macro challenges that the economy is facing and their impact on fundamental credit quality of borrowers will manifest in an increase in NPA levels, it said.

Also read : RBI Accedes 2 Lakhs Crores Advances Request By Modi Govt