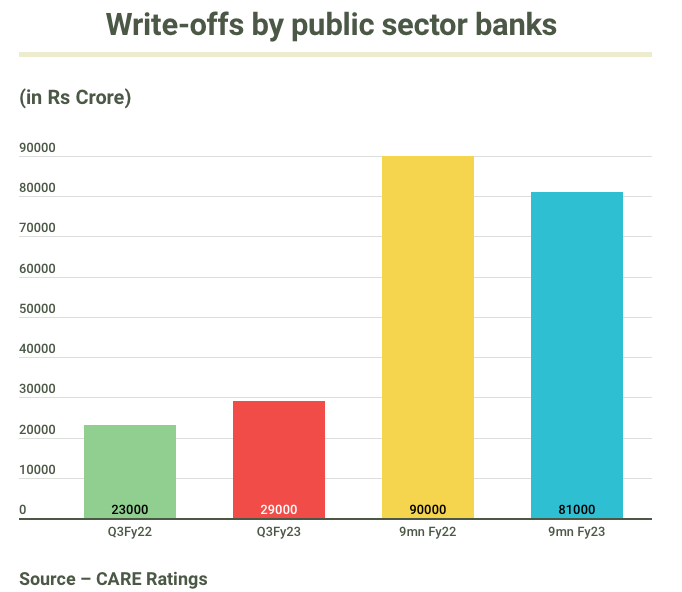

Public-sector banks (PSBs) in Q3FY23 wrote off bad loans worth Rs 29,000 crore, up from Rs 23,000 crore in the same quarter a year ago, as part of a clean-up exercise.

According to estimates by rating agency CARE Ratings, the write-offs by PSBs for nine months period in April-December 2022, at Rs 81,000 crore,

It was Rs 90,000 crore in April-December 2021.

Sanjay Agarwal, senior director, CARE Ratings, said a lot of it was driven by regulations, and assets that had 100 per cent provision coverage were written off.

A key point is that fresh slippages are happening at a much lower pace over the last two-three years and banks have been reducing bad loans on books through steps like write-offs. This trend is expected to continue.

Gross non-performing assets (GNPAs) are around 5 per cent for the banking sector as a whole. That should come down to 2-2.5 per cent, which was the level 10-12 years ago.

This indicates lot of work to be taken up as special drive by PSBs

In the case of PSBs like Punjab National Bank and Bank of India, GNPAs are still elevated.

Bank of India, Mumbai-based public-sector lender, wrote off Rs 2,522 crore in the third quarter, as against Rs 1,883 crore in the second quarter.

However, the write-offs were Rs 4,900 crore in Q3FY22.

The gross NPAs of 12 PSBs declined 18 per cent YoY to Rs 4.58 trillion at the end of December 2022. Sequentially, they declined from Rs 4.87 trillion at the end of September 2022.

As a result Net NPAs declined by 5.9% per cent to Rs 0.29 trillion at the end of December 2022