Stocks of Adani Group companies took a pounding in morning trade on June 14, falling as much as 25 per cent on report that NSDL has frozen accounts of three foreign funds that owned stake in four of the group companies.

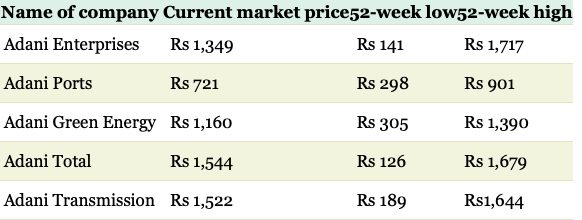

Among individual stocks, Adani Enterprises, the group’s flagship company, fell 25 per cent at Rs 1,201 apiece, followed by Adani Ports down 18 per cent at Rs 681.

So far in the current calendar year, Adani Enterprise has surged over three-fold, while Adani Ports and Adani Total Gas have zoomed over 100 per cent and four-fold, respectively.

ll six listed Adani Group companies were either locked in or were trading close to their lower circuit bands on the bourses on Monday, after National Securities Depository Ltd (NSDL) froze accounts of three foreign funds that own stake in four of these group companies.

As per a notice on NSDL’s website, accounts of Albula Investment Fund, Cresta Fund and APMS Investment Fund, which together own over Rs 43,500 crore worth of shares in four Adani Group companies, have been frozen “because of insufficient disclosure of information …

Shares of Adani Ports and SEZ also fell 19 per cent to hit an intraday low of Rs 681.60 and the market cap declined sharply to Rs 1.4 lakh crore.

[splco_Shortcodesspacer]

[splco_Shortcodesspacer]

The remaining listed companies of Adani Group Adani Total Gas, Adani Green Energy, Adani Adani Power and Adani Transmission hit 5 per cent lower circuits.

The foreign funds that have been frozen by NSDL hold stakes worth Rs 43,500 crore in four Adani group companies Adani Enterprises, Adani Green Energy, Adani Total Gas and Adani Transmission.

The accounts of Albula Investment Fund, Cresta Fund and APMS Investment Fund have been frozen on or before May 31, as per information on NSDL’s website.

An account freeze means that these foreign funds will not be able to sell any of the existing securities or buy any.

Officials at custodian banks that handle foreign investors said that the action has been taken against the foreign funds due to insufficient disclosure of information regarding beneficial ownership under the Prevention of Money Laundering Act (PMLA)

The report, quoting officials, said that custodians usually warn clients of such action, but the accounts can be frozen if the associated FPIs do not respond or fail to comply.

A statement from the Adani Group regarding the matter is awaited.The concerned Foreign Portfolio Investors too have not said anything.

[splco_Shortcodesspacer]

In the meantime, shareholder wealth has been eroded significantly and one has to wait and see as to what is happening.

It is a blow to billionaire industrialist Gautam Adani, who hails from Prime Minister Modi home state and also his close aide ., whose companies have witnessed a meteoric rise on the domestic stock market since last year, helping him become Asia’s second richest man.