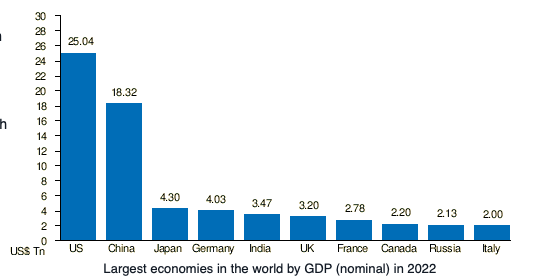

The Indian economy is expected to reach $7 trillion in the next seven years, chief economic advisor Anantha Nageswaran has said. He added that the economy will reach the $3 trillion mark by the end of the current fiscal (FY23).

Venkatramanan Anantha Nageswaran is an Indian economist and the 18th Chief Economic Advisor to the Government of India. He served as the global Chief Investment Officer at Bank Julius Baer in Switzerland after serving as its Head of Research for Asia.

In his Parliament speech PM Modi who leads BJP Union government previously said India would become a $5 trillion economy by 2025.

Speaking at a session organised by the Merchants’ Chamber of Commerce & Industry (MCCI) on Monday, Nageswaran said 2023 began in the context of the continuing conflict between Russia and Ukraine, which will “create geo-political and geo-economic uncertainties”.

The other major aspect is the opening up of China after two years of the pandemic and its impact on the world economy, particularly on retreating oil and commodity prices and also on the growth of the advanced economies of the US and Europe.

“In these contexts, the Indian economy will be of the size of $3 trillion at the end of March 2023 and $7 trillion in the next seven years, which is not impossible,” Nageswaran said.

He also said that the most important issue is that the US is expected to lower its interest rates in 2024 or 2025, which will have an impact on the Indian rupee.

The National Statistical Office (NSO) has predicted the economic growth of the country in FY23 to be 7 per cent in real terms and 15.4 per cent in nominal one. Nageswaran said the realistic medium-term growth is 6.5 per cent in contrast to 8 or 9 per cent, which was witnessed during the 2003-2008 period.

“During the 2003-2008 period, there was a global boom in terms of capital flows into India. The Chinese economy and commodity economies grew strongly. Now, the situation is different due to global monetary tightening, which will have a lag effect on all the economies,” he said.

He added that India has undertaken a lot of structural reforms, including the implementation of the Goods and Services Tax, and Insolvency and Bankruptcy Code, since 2016. Jan Dhan accounts have facilitated the seamless transfer of government benefits.

The improvement in digital infrastructure has the potential to contribute 0.2 to 0.5 per cent of the country’s GDP, he said. The corporate sector is now deleveraged and willing to borrow, and private capital formation is taking place at the moment, while banks are having low NPAs and are also keen to lend.