The rise/fall in index varied from state to state. Among the states, the maximum increase in the CPI-AL was in Andhra Pradesh, Karnataka, Rajasthan and Tamil Nadu and in the case of rural workers, the highest print was in Tamil Nadu. This was mainly on account of a rise in the prices of wheat-atta, jowar, bajra, onion, vegetables and fruits, and firewood.

On the contrary, the maximum decrease in the CPI-AL and CPI-RL was experienced in Assam, primarily due to a fall in the prices of rice, fish-fresh, chillies green, vegetables and fruits, among others.

In the case of agricultural labourers, it recorded an increase of 2 to 6 points in 14 states and a decrease of 1 to 12 points in 6 states. Tamil Nadu with 1,356 points topped the index table whereas Himachal Pradesh with 914 points stood at the bottom.

In case of rural labourers, there was an increase of 1 to 7 points in 13 states and a decrease of 1 to 12 points in 7 states. Tamil Nadu with 1,345 points topped the index and with 960 points, Himachal Pradesh stood at the bottom.

Retail inflation for farm and rural workers rose to 6.85 per cent and 6.88 per cent, respectively, in January, mainly due to higher prices of food items. In January last year, the inflation numbers for farm and rural workers was at 5.49 per cent and 5.74 per cent, respectively.

“Point to point rate of inflation based on the CPI-AL (Consumer Price Index Agricultural Labourers) and CPI-RL (Rural Labourers) stood at 6.85 per cent & 6.88 per cent in January 2023 compared to 6.38 per cent & 6.60 per cent, respectively in December 2022 and 5.49 per cent,” the labour ministry said in a statement on Monday.

The inflation readings for farm and rural workers stood at 6.38 per cent and 6.60 per cent, respectively, in December 2022.

Food inflation rose to 6.61 per cent and 6.47 per cent, respectively, last month from 5.89 per cent and 5.76 per cent, respectively, in December 2022.

For farm and rural workers, the food inflation stood at 4.15 per cent and 4.33 per cent, respectively, in January last year.

In January, the CPI-AL and CPI-RL increased by 3 and 2 points to stand at 1,170 and 1,181 points, respectively, compared to December last year.

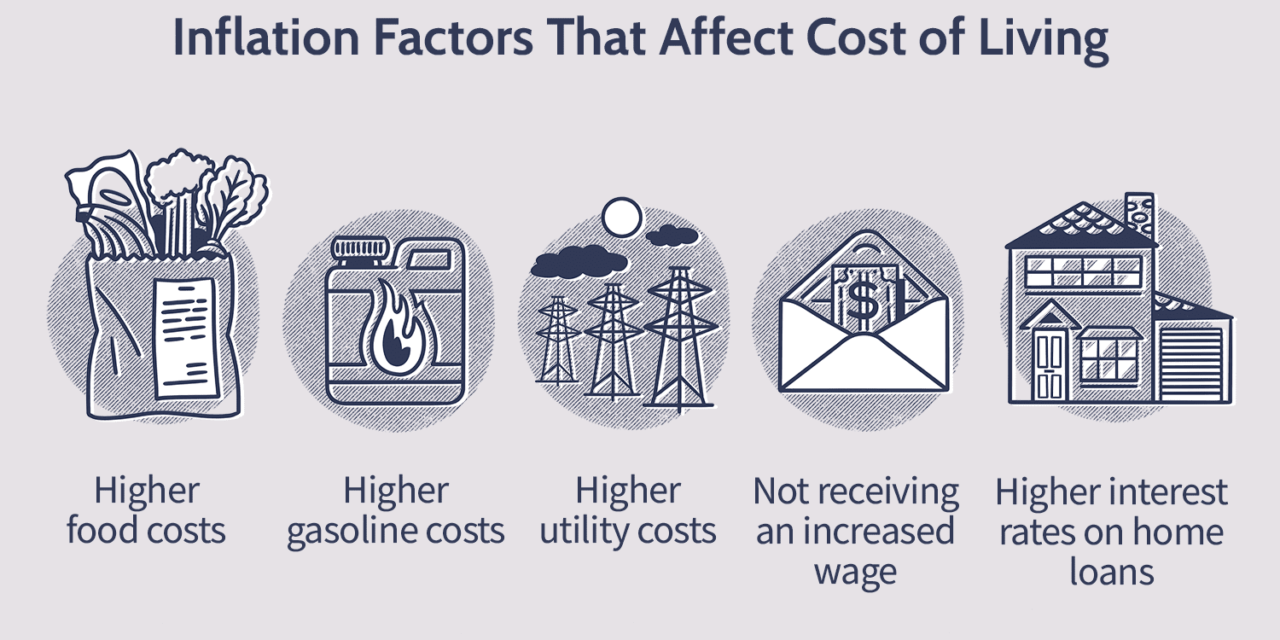

Inflation benefits those with fixed-rate, low-interest mortgages and some stock investors. Individuals and families on a fixed income, holding variable interest rate debt are hurt the most by inflation

Inflation brings most benefits to debtors because people seek more money from debtors in order to meet the increased prices of commodities.

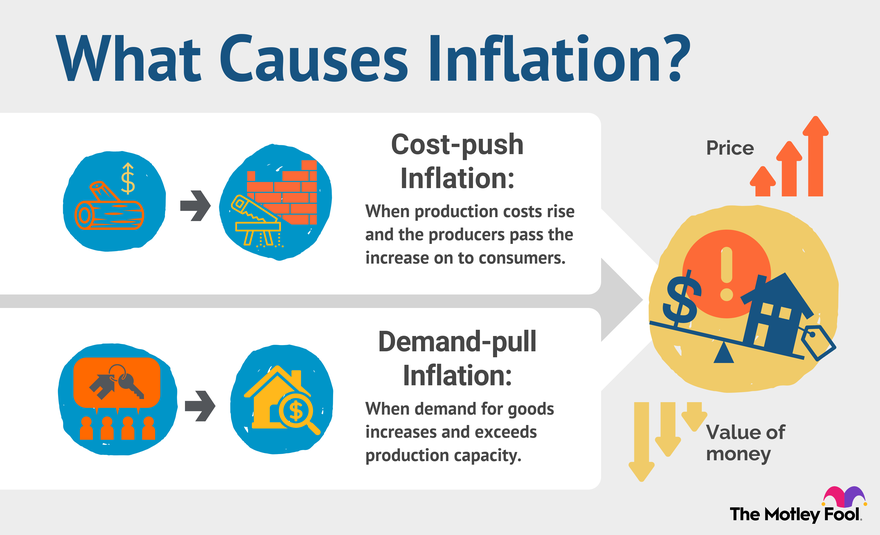

Reducing government spending would tamp down on demand-fueled inflation, while at the same time restoring confidence in the ability of the federal government to pay down the debt and thus control inflation expectations