COVID-19 outbreak, BJP Modi government late reaction leads to Sudden 21 days lockdown on march 24th declaration that caused panic amongst Indians.

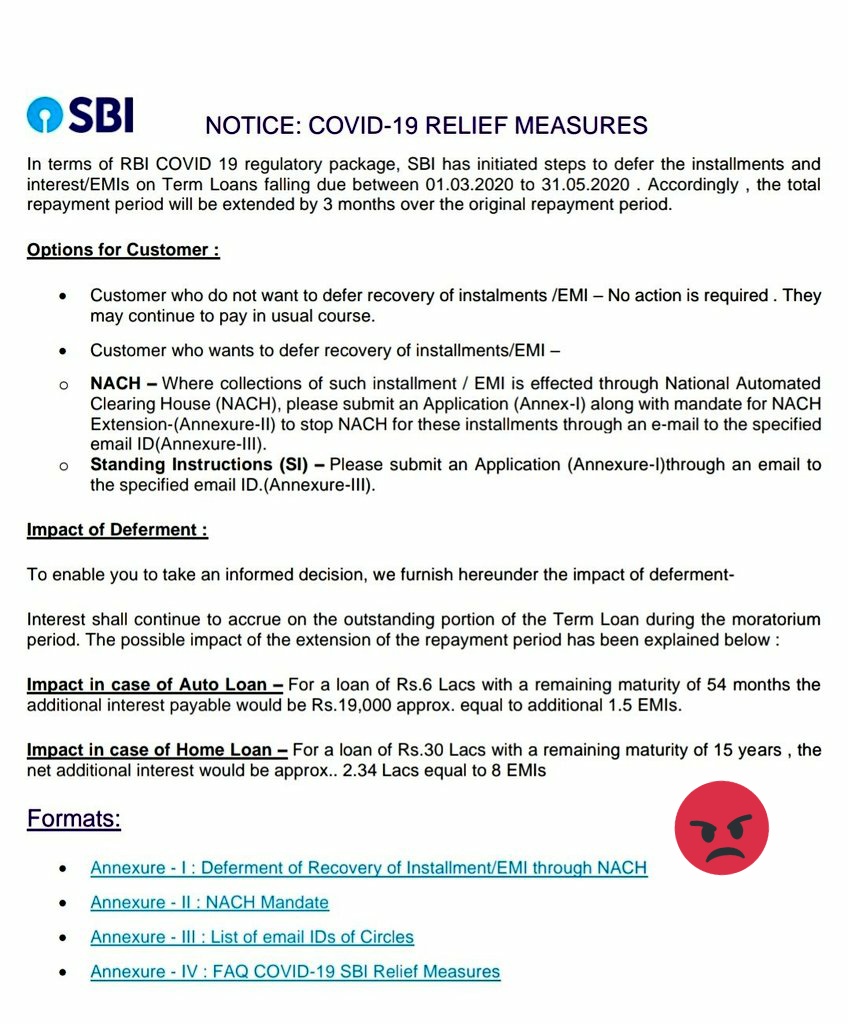

Following this Reserve Bank of India has permitted banks to allow a moratorium of three months on the payment of instalments for all term loans outstanding as on March 1, 2020.

It is to be noted a moratorium is not a loan waiver and does not offer any discount on interest payout. But it provides stressed customers extra time to repay without their accounts being labelled non-performing assets (NPA) or their credit score being affected.

Accordingly, the repayment schedule and all subsequent due dates, as also the tenure for such loans, may be moved forward across the board by three months.

However, the decision on the rescheduling of home, auto, and other loans will finally be taken and conveyed to customers by individual banks.

Also Banks will continue to charge interest on the outstanding portion of the terms loans during the moratorium period. The RBI has left it to the boards of banks to put in place an objective criteria to offer moratorium to its customers.

However as the new EMI cycle has already started, banks seem to be unprepared Major Banks in inda have not yet announced the details of the relief package

Top lenders like SBI, ICICI and HDFC have have kept the customers clueless about the moratorium . Borrowers are confused as many received text alerts regarding their EMIs

As per above Schedule for 3 months moratorium fora loan of 30 lakhs having maturity for 15 years additional interest 2.34 Rs or 8 more months EMI

Banks are not ready yet to implement the special facility created by the RBI . Most bank branches when contacted by borrowers got a stereo type messgae that have not received any instructions from their headquarters

Adding to the worries of borrowers , Bankers suggested, deferring EMIs is no beneficial for those who can pay. Another private bank executive said that the whole thing will take time

Sources told, the SBI will offer borrowers to repay failing which the EMIs will be deferred. HDFC will reach out to borrowers over the next few days, a spokesperson said

Borrowers will also have the option to continue with the EMIs. But the fact is until the banks decide,most banks will charge penalty for non payment

Sources reveal that, missing two instalments could extend the loan by 6-10 months… or increase the EMI amount by 1.5%. The borrower may be given three options by the lender:

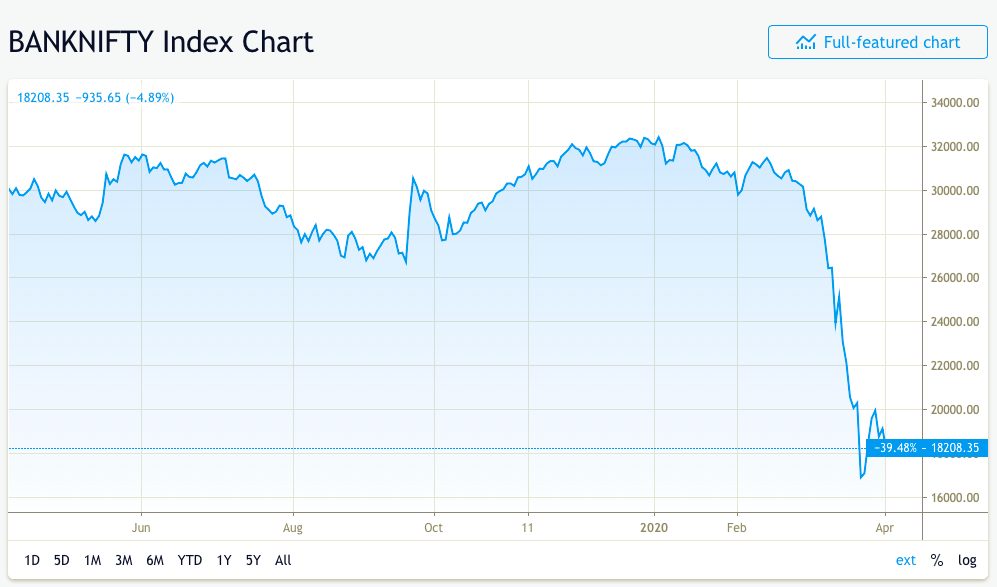

From 1st Feb 2020 till 31 March 2020 a fall. of 41% in bank Nifty stocks send shivers in market

As RBI failed to give clear terms now various options are left out with banks says inside sources :

Option I: One-time payment in June of the interest that accrues in April and May

Option II: Add the interest to the outstanding loan and increase EMI for remaining months

Option III: Keep the EMI unchanged but extend the loan tenure.

RBI lack of clarity causes Panic and confusion among borrowers is increasing with delay in communication by banks

If this is unchecked then the RBI’s EMI relief turns to be hoax as banks seem to be in no mood to relax the payments as on date

Mean while Prime Opposition party Congress urged the Union finance minister to intervene not only to ensure banks comply with the Reserve Bank of India’s directive for deferring payments of equated monthly instalments (EMIs) on all loans for three months due to the Covid-19 emergency but also to provide subvention of interest rate of the deferred EMIs.

Party spokesman Manish Tewari made this demand to the ministry amid reports that many banks were proceeding to follow the regular EMI deduction schedule despite the RBI’s nod for deferring them for three months. He demanded that the FM immediately make the banks issue the necessary notifications in line with the RBI-advised three-month moratorium and stressed that the subvention of interest rate on EMIs for the threemonth period was equally important to ensure the intended relief for customers.