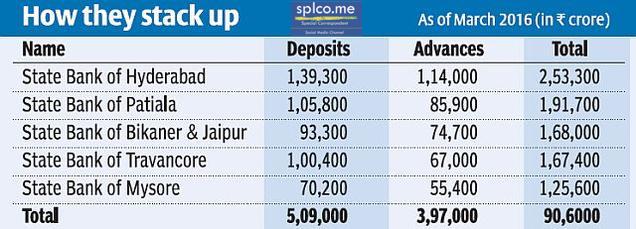

In gazette notifications published on 23/02/2017 the government said the entire undertakings of these five banks:

State Bank of Bikaner & Jaipur

State Bank of Mysore

State Bank of Travancore

State Bank of Patiala and

State Bank of Hyderabad

shall stand transferred to and vested with State Bank of India from April 1, 2017. In pursuance SBI informed stock exchanges about the effective date of the merger of these Five banks to its main fold.

The Union Cabinet earlier this month ratified the merger of thee five banks with SBI. The Implications of the merger will create a bigger SBI that will account for nearly a quarter of all outstanding loans in the country.

The merger is likely to result in recurring savings, estimated at more than Rs.1,000 crore in the first year, through a combination of enhanced operational efficiency and reduced cost of funds, the Central government maintained.

Hence forth SBI entity will have a network of nearly 23,000 branches, further increasing the dominance of the country’s largest bank.

The government had earlier said the SBI-associate merger was an important step towards strengthening the banking sector through consolidation of public sector banks. However market reacted negative and SBI’s shares closed 0.5 per cent lower at Rs 270.50 when the merger been made with gazette notifications.

your reviews / critics are valuable to us . your news making skills can also be jointly done in our novel unique social media news making platform kindly get in touch with our team who vows to bring news told in its pure kind from splco Social Media channel for deserved people.

Comments

Comment on this article: