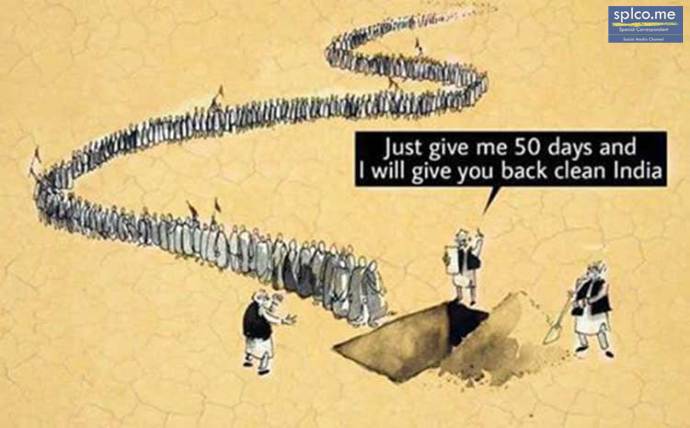

The GST Council Meeting on Friday under the Chairmanship of Union Finance Minister Arun Jaitley decided to make changes in the GST rates of 27 goods inclusive of reduction of tax rates for items including diesel engine parts, man-made yarn, ready-to-eat snacks, plastic and paper waste.

Bowing down to Indian exporters pressure ., within the next 4 days i.e. by 10.10.2017 the held-up refund of IGST paid on goods exported outside India in July would begin to be paid. The August backlog would get cleared from 18.10.2017 and refunds for subsequent months would be handled expeditiously.

After the day-long GST Council meeting, Finance Minister Arun Jaitley said small businesses would be allowed to file tax returns once a quarter instead of every month. He also said duties would be cut on some products and the threshold for lower tax would be raised.

It has now been decided to exempt those service providers whose annual aggregate turnover is less than Rs. 20 lacs (Rs. 10 lacs in special category states except J & K) from obtaining registration even if they are making inter-State taxable supplies of services.

To facilitate the ease of payment and return filing for small and medium businesses with annual aggregate turnover up to Rs. 1.5 crores, it has been decided that such taxpayers shall be required to file quarterly returns in FORM GSTR-1,2 & 3 and pay taxes only on a quarterly basis, starting from the Third Quarter of this Financial Year i.e. October-December, 2017.

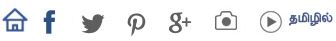

Soon after, Narendra Modi hailed the GST Council’s decision to lower rates for 27 commodities and increase the turnover threshold to Rs 1 crore.

However prime opposition party congress communications incharge Randeep Surjewala said, reduction in GST rates as "too little, too late" and said a lot more needs to be done to address concerns of people under the new tax reform measure.