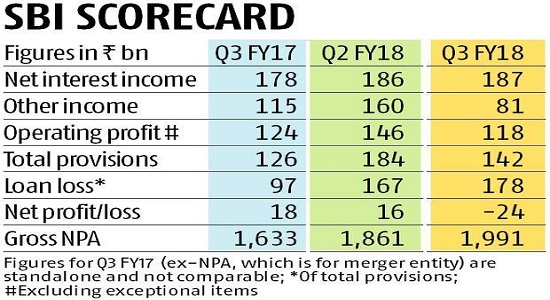

The country's largest state-owned lender, State Bank of India (SBI) on Tuesday reported its biggest ever quarterly loss of Rs 7,718 crore in January-March quarter.

Last year for the same period SBI had reported a net profit of Rs 2,815 crore. The loss came due to the mounting bad loans in Q4.

However, despite posting its biggest quarterly loss, SBI had one of the best days on the indices. SBI's share price jumped 6% during the day on Tuesday, hitting a high of Rs 259 apiece before ending 3.7% higher at Rs 254.15, after the management indicated that the deterioration in the asset quality is complete.

The loss would have been higher had it not been for a write back of Rs 4,495 crore during the quarter. This is the second consecutive quarter that the bank has reported losses.

Not just SBI, banks saw soured loans and provisions surge in the quarter after the Reserve Bank of India (RBI) in February eliminated half a dozen loan restructuring schemes to hasten the clean-up of near-record levels of bad debt. Most state-run banks that have reported quarterly earnings so far have posted losses.

SBI’s bad-loan provisions for the quarter more than doubled from a year earlier to Rs 280.96 billion. Gross bad loans as a percentage of total loans rose to 10.91 per cent from 10.35 per cent three months earlier and 6.90 per cent a year prior, the lender said in a statement.

The SBI management had already indicated that quarterly results will be “very bad”, so this was anticipated, said A K Prabhakar, Head of research at IDBI Capital.

"Markets appeared to be impressed by the SBI results for two reasons. Firstly, there is the first indication that the NPA cycle may be turning around and combined with growth in advances, this could result in improved profitability in the coming quarters. Secondly, the NCLT resolution will result in a write-back of close to Rs 1 trillion for Indian banks and SBI is likely to be the biggest beneficiary," said Jaikishan J Parmar, analyst with Angel Broking.

SBI's loss will be the second largest loss after Punjab National Bank(PNB) reported its largest ever loss of Rs 13417 crore hit by the Nirav Modi scam which siphoned off almost the same amount of money from PNB.

The bank's total income during the quarter was also down 3.87% over the year ago period at Rs 68,436 crore. The net interest margin (NIM) was down at 2.67% from 3% the same time last year. The NII, which is the difference between interest earned and interest paid, was Rs 19,974 crore, down 5.18% from Rs 21,065 crore in Q4FY17.

Meanwhile, State Bank of India's chairman Rajnish Kumar on Tuesday said the lender is looking at selling stakes in some of its subsidiaries over the next two years.

"All our subsidiaries have done exceedingly well. They hold large value which is waiting to be unlocked. We have plans to unlock that potential in the current as well as in the next year," Kumar told reporters on Tuesday.

The bank is planning to sell its stake in SBI General Insurance, SBI Card and SBI Capital Market, he said.