Reuters reported last month that India's state-run banks reported 8,670 "loan fraud" cases totalling 612.6 billion rupees over the last five financial years up to March 31, 2017.

These are the six projects that BJP 's modi has claimed success in all elections campaigns but progress has not been made not even one fifth on expected lines, with their average fund utilisation standing at 21.6 per cent.

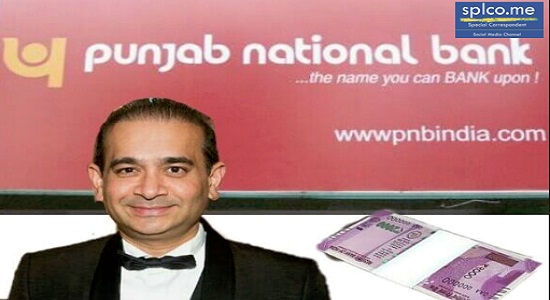

India's Punjab National Bank lost Rs 28 billion ($431 million) to various frauds last financial year, the government said on Friday, making it the biggest such loser among all state-owned banks even before it uncovered an alleged $2 billion fraud this year.

The country's second-biggest state-owned bank in February accused two high-profile jewellers and their companies of colluding with rogue bank employees to secure credit from overseas lenders using fraudulent guarantees that peaked highest under Modi era.

NM Leo news adds that a demand made by Mr. Modi in 2009 included ensuring “perennial flow of dollar finance”, doubling of “interest subversion” (subvention or interest subsidy) to four percent and waiver of penal interest on export credit. He also sought deferred payment facility for service tax for two years.

Modi magic started showing results the way diamonds glitter. On 13th February 2009, Reserve Bank of India (RBI) issued a circular, delegating its powers to grant permission for opening diamond dollar accounts (DDAs) to certain banks.

RBI also constituted a task force (TF) on diamond sector. In its report dated 26 February 2009 prepared at Ahmedabad, TF accepted Mr. Modi’s demand for doubling interest rate subvention to 4%. TF also recommended “expeditious restructuring of the existing borrowal accounts as per RBI guidelines”. It also recommended that banks would examine industry’s demand for sanction of credit against stocks of polished diamonds.

Another recommendation called upon the banks to quickly process applications for loans sought by new diamond units.

TF stated : “The progress in the implementation of the above recommendations will be monitored jointly by the Reserve Bank of India, the Government of Gujarat and the banks through the forum of State Level Bankers’ Committee”.

On 29th October 2009, RBI relaxed the eligibility norms for diamond companies for opening of DDAs. The credit liberalization for diamond industry continued with the passage of time. Diamond sector also received a leg-up under Foreign Trade policy for period 27th August 2009 to 31st March 2014. In all fairness to Mr Modi, it must be noted that seeds for misuse of letter of undertaking (LOUs) by Nirav Modi and Gitanjali groups were sown way back in November 2004 shortly after UPA came to power. In a circular dated 1 November 2004, RBI dispensed with the requirement of companies & dealing banks seeking its prior approval for issue of LOUs/letters of comfort (LOCs) for import credit. It is thus clear banking and export-import rules for diamond business were liberalized in good faith by Congress-led UPA Government at the prompting of BJP Government in Gujarat. This has been dubbed as the biggest bank fraud in India's history, but the finance ministry told parliament that even before the fraud came to light, state banks lost a total of Rs 195.33 billion to 2,718 cases of fraud in the year that ended on March 31, 2017. Punjab National, better known as PNB, alone reported 158 cases of fraud in 2016/17, the ministry said. PNB did not immediately respond to a request for comment. In monetary terms PNB was followed by Bank of India, which lost 27.7 billion rupees, and State Bank of India that lost 24.2 billion rupees, the ministry said. The BJP ministry does not disclose and did not specify the nature of the frauds but only added that the central bank recently formed an expert committee to look into "factors leading to increasing incidence of frauds in banks and the measures needed to curb and prevent it". The committee will also look into the role of auditors in checking frauds. In India, loan fraud typically refers to cases where the borrower intentionally tries to deceive the lending bank and does not repay the loan. A parliamentary committee on finance said in a report on Friday that "it was extremely concerned about the recent fraud detected in Punjab National Bank, which clearly reflects that a small group of individuals can manipulate such a gigantic bank and compromise it despite such well laid out norms, guidelines, checks and balances."