Post demonetisation the economic downturn resulted in rising of bad debts (NPAs) and more particular sorry state of public sector banks, IDBI rank the lowest of all.

The bank’s gross non-performing assets (NPAs) rose to Rs 55,588 crore in March 2018, up from Rs 44,753 crore a year earlier.

Its gross NPAs are nearly 28% of its total loan book (the highest among all banks). India Ratings, a credit ratings agency, reckons that if all of its distressed loans, which are currently classified as standard assets, are to be marked down, the bank’s NPAs would rise to almost 36% of its total advances.

With its losses widening to Rs 5,663 crore for the quarter ending March 2018, up 77% from the Rs 3,200 crore loss reported in March 207, IDBI will be a money-grabbing blackhole for the next three years.

More alarmingly, its capital position remains dangerously close to the minimum requirement of 7.375% even though the Modi government plowed in a little over Rs 10,000 crore of taxpayers’ money into the bank last fiscal year.

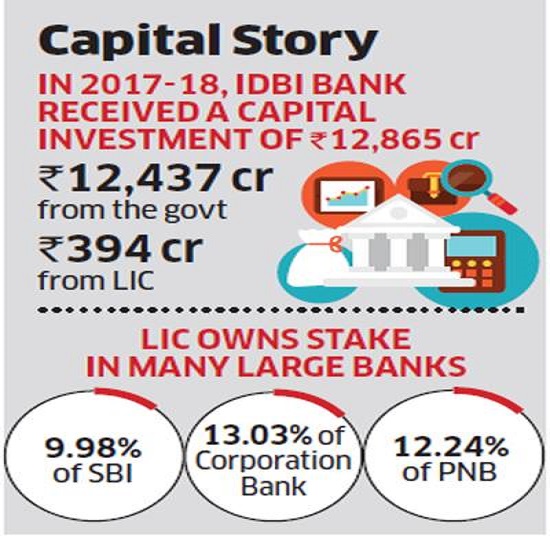

In this above scenario LIC comes to aid helping hand and The Insurance Regulatory and Development Authority of India (Irdai) board on Friday approved Life Insurance Corporation’s investment in IDBI Bank, allowing LIC to own up to 51 per cent in the beleaguered lender.

LIC, which holds stakes in several banks, will also need the Reserve Bank of India's (RBI's) approval to own such a large stake in IDBI Bank.

LIC will now be able to pump Rs 100-130 billion into IDBI Bank in tranches through a preferential allotment of new equity shares at a price determined by a formula under the Securities and Exchange Board of India’s (Sebi’s) rules.

However, Irdai put some caveats and directed the insurer to bring down its stake in IDBI Bank over a period of five-seven years. “The regulator has asked LIC to submit a plan with a timeline for paring its stake in the bank,” said a government official in the know.

LIC sources maintain that it will only be an investment for the insurer. “LIC would remain a strategic investor in the bank and it will not control the bank’s management,” said a source. However, the insurer will appoint one or two directors to the bank’s board.

The deal comes with several regulatory challenges, though. It will trigger an open offer as LIC will acquire more than a 26 per cent stake in the fresh issue.

Also, it is not clear whether LIC’s shareholding will be considered public shareholding. IDBI Bank’s current public shareholding, at around 19 per cent, is below the Sebi-mandated 25 per cent. LIC and IDBI Bank would need to seek clarification on both issues from the market regulator.

LIC, which holds stakes in several banks, will also need the Reserve Bank of India’s (RBI’s) approval to own such a large stake in IDBI Bank. Both IDBI Bank and LIC own mutual fund arms, which too are not allowed under the Sebi rules.

LIC will also end up owning a stake in IDBI Federal Life Insurance after this purchase, which will be a breach of Irdai’s regulations. Irdai may already have considered this issue before giving the clearance.

However, experts are optimistic on LIC getting all due regulatory clearances as it is a government-owned institution, which has rescued ailing public sector banks in the past too.

V G Kannan, chief executive, Indian Banks’ Association (IBA), said, “Running a bank is not the same as managing an insurance company and the LIC management wouldn’t have the bandwidth to run a bank.” The control should not vest with the insurer, he added.

The government has been attempting to bring a strategic investor in the ailing public sector lender for over three years but has not met with success. International Finance Corporation had done due diligence of the bank’s books, but the matters did not move ahead.

Currently, IDBI Bank is under the RBI’s prompt corrective action framework due to very high level of bad loans.

Read Also: Is RERA just a toothless tiger